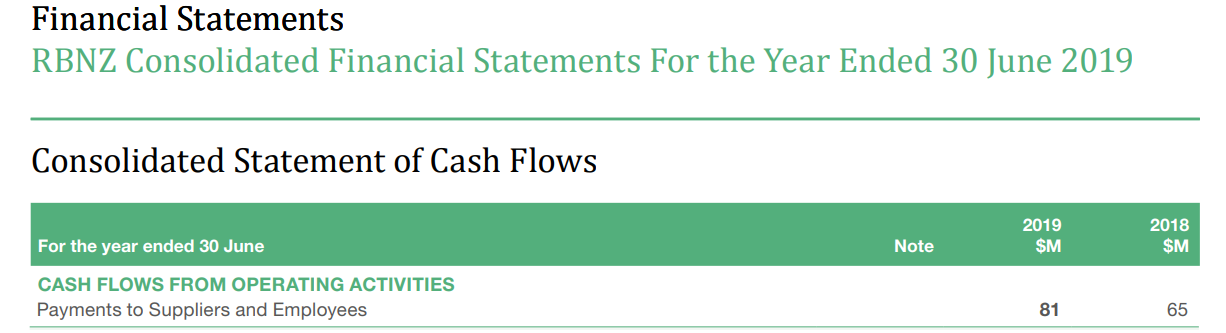

The Reserve Bank Grift #1: Payments to Suppliers and Employees

In the 10 years to 2023 the Reserve Bank of New Zealand grew their 'wage bill' by ~9% per annum from $65M to $152M

The Reserve Bank of New Zealand does not produce anything real1. To not produce anything they had a ‘wage bill’ for FY2022-23 of $152M. It’s not clear what ‘suppliers’ specifically are; the Reserve Bank’s Financial Statements do not give a definition. The assumption here is because suppliers are grouped with employees, they’re contractors and consultants2.

2014 - 2023 Suppliers and Employees Line Item Grew +134%; ~9% per annum

2023 152 +9%3

2022 140 +26%

2021 111 +11%

2020 100 +23%

2019 81 +25%

2018 65 -25%

2017 87 +21%

2016 72 +20%

2015 60 -8%

2014 65

2022 - 2023 $152M

2021 - 2022 $140M

2020 - 2021 $111M

2019 - 2020 $100M

2018 - 2019 $81M

2017 - 2018 $65M

2016 - 2017 $87M

2015 - 2016 $72M

2014 - 2015 $60M

See also:

https://www.interest.co.nz/banking/124734/reserve-bank-staffing-levels-and-personal-costs-surge-over-past-five-years-it-takes (4th Oct 2023)

The only item the RBNZ ‘produces’ is currency, which is created out of thin air. They do sell coin and banknotes to private banks, a ‘business’ from which they gain profit (seigniorage).

Possibly costs of production of banknotes and coins. Though for all I know it includes pens and coffee mugs as well.

Percentages are rounded.