Media Questions for Adrian Orr: 22 April: BIS's Agustín Carstens, CBDCs & control. RBNZ redefining words and more communication issues.

Central bankers will have complete surveillance and control of when, where, and how we can use our bank deposits.

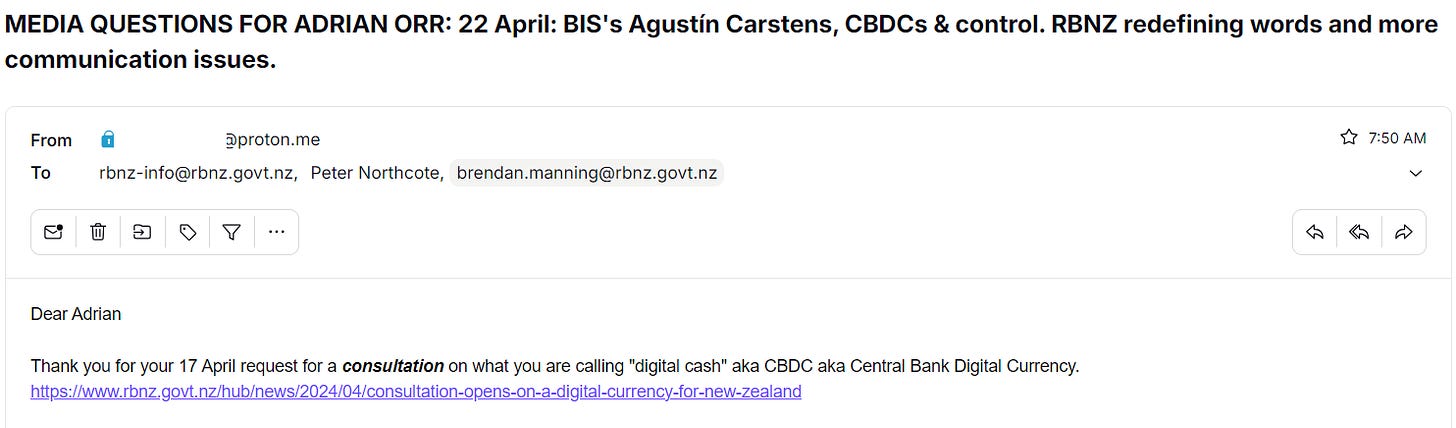

Emailed 22 April 2024.1

Dear Adrian

Thank you for your 17 April request for a consultation on what you are calling "digital cash" aka CBDC aka Central Bank Digital Currency.

https://www.rbnz.govt.nz/hub/news/2024/04/consultation-opens-on-a-digital-currency-for-new-zealand

QUESTION 1: Do you agree with Bank for International Settlements' General Manager Agustín Carstens when he said (I paraphrase)?

Our bank deposits are not ours—they are an “expression of central bank liabilities”—in other words, it is your (RBNZ) money, not ours.

This would of course tie in with your statement to Parliament's Finance and Expenditure Select Committee2 on 12 February that

"we print money. And people believe it. Touch wood."Central bankers will have complete surveillance and control of when, where, and how we can use our bank deposits.

CBDC's can be used to enforce rules centrally.

You can see Carstens' in action here: https://home.solari.com/the-threat-of-financial-transaction-control/

Your colleague, Director of Money and Cash Ian Woolford, said in the 17 April release that this so-called digital cash "would be a new type of money”.

QUESTION 2: When the RBNZ says "money" does it actually mean "expression of central bank liabilities" as Agustín Carstens says?

Regarding your request for consultation, I'm happy to consult for the RBNZ, but you will need to pay me. And as I only accept money, and certainly not ‘expressions of central bank liabilities’, please forward to me a one troy ounce gold coin, numismatic and 22 carat, as an advance payment.

Furthermore, you once again seem to have a problem with language. You seem to be redefining words and confused with what you say. For example

Cash: I always though the word 'cash', when used as a noun, was a physical thing. So I looked up the etymology. And I was right. Obviously a digital thing is not a physical thing, so when you say "digital cash"

QUESTION 3: Are you redefining 'cash'?

You said "we print money and people believe it. Touch wood."

Then you said that's not what you meant.

https://www.nzherald.co.nz/business/reserve-bank-governor-adrian-orr-interview-why-your-purchasing-power-has-eroded/D27TRAIKJBH27EWESIMOGWA2TU/QUESTION 4: Which is correct? What did you mean?

QUESTION 5: When you said "print money" did you mean "print central bank liabilities" as Augustin Carstens called it?

You said you are "cautiously confident" about inflation.

https://www.interest.co.nz/economy/127237/reserve-bank%E2%80%99s-monetary-policy-committee-adds-word-%E2%80%98confident%E2%80%99-its-inflationQUESTION 6: Does this mean the RBNZ is “cautiously confident“ it is going to stop inflating the money supply? That is printing currency.

QUESTION 7: Can you please stop printing currency? And stop allowing banks to increase the money supply and debasing the currency (I realise stopping this debt creation which debases the currency would destroy the economy, but you're doing that anyway).

QUESTION 8: Do you think currency debasement should be a criminal offence?You said that cash was being used less and less, yet actual data shows this is a lie.

QUESTION 9: Do you still stand by your claim that cash is being used “less and less”?You have two employees, Brendan Manning and Peter Northcote, whose job titles are respectively Manager, External Stakeholders, and Senior Advisor External Stakeholders. They refuse to respond to my questions.

I suspect it's because they don't like them, or are afraid of the answers, because I have never once been rude, abusive or nasty, and challenge them to provide one example to counter my claim. I assumed these job titles were just fancy words for press secretaries, but I may be wrong. Either way, they refuse to respond. Therefore I have to assume I am not a "stakeholder".

QUESTION 10: As a reluctant user of your non-competitive product, your 'expression of central bank liability' in Carstens’ words, am I a stakeholder? If I'm not as a user, who is?You said in September 2020.

"lower interest rates inflate asset prices...Higher house prices, for example, make people feel wealthier, more inclined to spend, which supports the economy.

https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/speeches/2020/Speech2020-09-02.pdf

Though it’s touching that you care that people “feel” wealthier

QUESTION 11: Do you think people are wealthier?

QUESTION 12: Do you still stand by this Sept. 2020 statement?

QUESTION 13: Does the Reserve Bank still stand behind it's motto (below) emblazoned on your website?

"We enable economic wellbeing and prosperity for all New Zealanders."

Regards

See also:

Whoops. Left the words “Select Committee” out of the email. Oh well. Perfect in my next lifetime.