NZ Financial Resets: Part 4d: Treasury Beguiles and A Prussian's Wiles: An Orchestrated Litany of Lies - #1 & #2

The deception's foundation...and the net is closing...

“…the power to make a small piece of paper, not worth one cent, by the inscribing of a few names, to be worth a thousand dollars, was a power too high to be entrusted to the hands of mortal man. — John C. Calhoun, U.S. Senate, Dec. 29, 1841

Previous: 1930/1931 - A Prussian's Wiles

Next: A Central Bank Interlude

Home: New Zealand’s Financial Resets

Prologue

In his 1981 Royal Commission report into the Erebus disaster, Justice Peter Mahon summarized the evidence brought before him by executives of the State-owned airline Air New Zealand, and in doing so a new expression entered New Zealand’s phraseology:

“I am forced reluctantly to say that I had to listen to…"

An orchestrated litany of lies

This essay begins the examination of the claims made by the London bankers to justify their call for a New Zealand central bank. A range of lies were used to move the country in that direction. They lied by omission and in fact to distort the debate and create distractions. Why? To obscure their true intentions, and in this they were wildly successful. But the foundational lies came first.

The Foundation

Lie #1: Money Printing

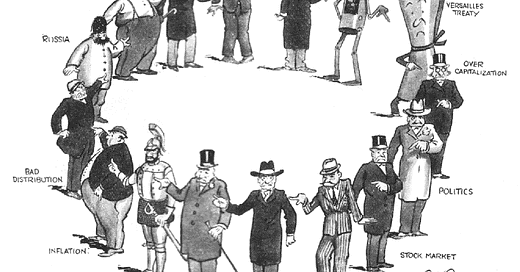

Ashwin and Niemeyer didn’t appear from nowhere in 1930. A decade earlier, using the economic and financial chaos consequent of the 1914-1918 war, and under cover of the League of Nations and its economic conferences, prominent and powerful bankers had initiated calls for a global central banking regime.1

By 1930 the ultimate cause of the crisis had been repeatedly identified at the economic conferences and by prominent economists. It was the money printing. Currency debauchment. A “fraud upon the public.“ An “indefinite increase in the amount of currency.” The “printing presses.” And this about all countries involved in the war. Nor were these the beliefs and words of cranks.2

It is inconceivable that Niemeyer, Ashwin, his boss Treasury Secretary Alexander Park or the other senior Treasury staff were not intimately familiar with all the financial documents and sentiments of the League of Nations’ conferences. Or the conclusions of the leading economic analysis of the day, which was unequivocal.3

The results of the printing presses had manifested in New Zealand as high inflation, a high British exchange-rate, rising interest rates, and the collapse of exports and export prices. The consequence was high import prices and high unemployment. But, to paraphrase the President of the 1922 Genoa Conference’s Financial Commission, the “indefinite” inflation of currency by all belligerent nations in the (then) preceding eight years was the ultimate cause. A currency inflation that had continued.4

This fundamental issue, the cause of the economic chaos globally, was never addressed publicly by either Treasury, Niemeyer, the press or politicians. Instead they blamed proximate effects.5

This was…

LIE #1:

Massive currency creation, the core issue, was never addressed.

But there was another factor which complicated things, linked to the first lie.

Lie # 2 - The Sterling-Gold Standard

The Value of Nothing

One of the aims of the League of Nations’ conferences was to establish a relative value for the various currencies which had been printed ‘indefinitely,’ as a prerequisite for meaningful international trade to resume. Gold was the only alternative on the table. In 1925 Britain returned to a gold standard, but at a sterling-gold exchange rate that was so overvalued its ultimate failure was only a matter of time. Bankers were trying to extract value from nothing—‘nothing’ being the currency created from thin air.6

Bankers and many economists argued there was not enough gold in the world, so the value had to be come from somewhere. Some of that value had already been extracted, in the form of the high post-war consumer-price-inflation and increased taxation seen in all belligerent countries. By 1930, when Niemeyer came to New Zealand, sterling’s gold-exchange-standard failure was only a year away, and he would have had intimate foreknowledge of this impending event.7

That sterling was severely overvalued and that its failure would be the eventual result was not rocket science. That this overvaluation was an important contributing factor to why New Zealand’s ‘Great Depression’ manifested in the way it did at that time was also not rocket science. Yet this was never part of the public narrative of the bankers, politicians or press.8

This was…

LIE #2.

Collapse of the ‘new’ sterling gold-standard currency was inevitable from the start.

Something had to give

In 1931 it did. Six years after Britain reconnected sterling to gold, a few months after the Bank of England ‘expert’ visited New Zealand, with reserves including gold flooding out of Britain

Suspension of the gold standard was decided upon…in consequence of continued large withdrawals of funds…amounted for the period to $1,000,000,000, of which about $160,000,000 represented a loss of gold during the latter part of July, which reduced the gold reserves of the Bank of England from $810,000,000 to $650,000,000, and the rest the loss of foreign exchange…Federal Reserve Bulletin Vol. 17 No. 10, October 1931 p 554.

The London bankers just didn’t want to let go of the gold.

These two deceptions, both lies by intentional omission, might seem almost mundane.

They were in fact profound.9

What followed, the ultimate bait-and-switch, was not possible without first establishing these two foundational lies. If the public had understood it was these same actors, the London bankers, who had reduced them to the state they were in it is doubtful what came next would have been possible. But the public were demoralised and deceived and the net, which they didn’t even realise was cast, was fast closing.

More lies were needed, to create the distraction, shift the focus, and hide the ultimate prize.

See full texts of some of the documents used in Part 4.

Previous: 1930/1931 - A Prussian's Wiles

Next: A Central Bank Interlude

Home: New Zealand’s Financial Resets

“under cover of the League of Nations“

Which itself was the creation of powerful bankers. Understanding this requires a relearning of the false history taught in public education. Beyond the scope of this work. To make a start have a look at the brief introduction to Theodore Marburg and other sources here…

“economic conferences“

1920—League of Nations Brussels International Financial Conference*

1922—League of Nations Genoa Economic and Financial Conference**

1923—Imperial Conference in London. Also called the Imperial Economic Conference. Attended by New Zealand Prime Minister William Massey, it adopted the resolutions of the two earlier conferences.

1927—League of Nations World Economic Conference, Geneva.***

“prominent and powerful bankers“

“an international petition…signed by prominent individuals that included…J. P. Morgan Jr., Richard Vassar Vassar-Smith, Gerard Vissering, Paul Warburg” [all bankers]

https://en.wikipedia.org/wiki/Brussels_International_Financial_Conference_(1920)

Morgan and Warburg, both powerful New York bankers, were central actors in the creation of the U.S. Federal Reserve system.

* Brussels International Financial Conference

In February 1920 the League of Nations called for the conference to study “the financial crisis and looking for the means of remedying and of mitigating the dangerous consequences arising from it" — Report of the International Financial Conference, League of Nations, Brussels (1920) p 225.

“The Conference is of the opinion that in countries where there is no central bank of issue, one should be established“ — ibid p 235.

** Genoa Economic and Financial Conference

The Conference Report mentions central banks at least 34 times.

The President of the Financial Commission, British politician Sir Laming Worthington-Evans, felt “the power to influence prices, and the responsibility for using that power, belong to the great central banks.” — Saxon Mills, J., The Genoa Conference, Hutchinson & Co, London (1922) p 153.

They wanted gold out of circulation.

”The scheme is based on the most modern and scientific method of economizing the use of gold as currency.” — ibid p 154.

The final resolution of the Genoa Conference recommended “the establishment of an International Corporation, with national corporations affiliated to it, in order to render financial and technical facilities in the reconstruction of Europe“ — ibid p 144.

This was the model adopted for the Bank for International Settlements.

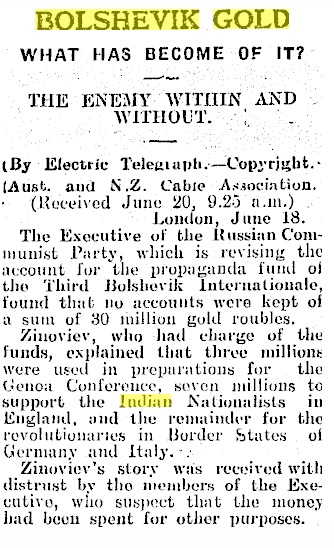

Addendum: BOLSHEVIK GOLD, Feilding Star, 20 June 1922, Page 2

https://paperspast.natlib.govt.nz/newspapers/FS19220620.2.26

*** World Economic Conference

New Zealand was represented by Sir George Elliot, Chairman of the Bank of New Zealand, and Professor James Hight, Dean of the Faculty of Commerce, Canterbury College, University of New Zealand. The World economic conference, Geneva, May 1927 : Final report

This conference was supported by (among others) a 574 page supporting document Memorandum on Currency and Central Banks.

Both the International Financial and Genoa conference’s seemed to struggle with the issue of how gold should fit into the financial system and perhaps most importantly how to price it and what against. But it is clear both conferences felt gold in some form was the most important mechanism, though not a cure-all, for settlement of international trade. Nothing else gets a mention.*

Some examples from the latter and probably more relevant conference,** the report which includes at least 75 mentions of gold:

“The report advises that gold should be adopted as the common standard,“ — Saxon Mills (1922) p 151.

”It is a mistake to suppose a return to the gold standard is a solution of all our difficulties” — ibid p 152.

”In the resolutions which have been passed…there is embodied the principle of preventing undue fluctuations in the purchasing power of gold, and…in the purchasing power of currencies based on gold.” — ibid p 152.

”This policy pre-supposes the general return to the gold standard.” — ibid p 153.

”A detailed programme has been elaborated which points out to each country the way to re-establish the effective gold standard.” — ibid p 163.

”Article 32. Gold is the only common standard which all European countries could at present agree to adopt.’ — ibid p 349.

* “international trade“ — for example, in reference to gold’s role in achieving comparative price stability, “The Genoa Financial Report marks an important stage in the advance towards that stabilization of the exchanges without which it is impossible to set the wheels of commerce once again in motion.” — ibid p 144.

** “relevant conference“ — assuming thinking was evolving.

“the ultimate cause of the economic chaos“

The histories of individual economies and currencies during the post-World-War-One period is complex and well beyond the scope of this essay. Aside from the war which everything stemmed from, in a sentence, the massive debt accumulation and money printing was bad enough; the attempted international gold-exchange standard for trade increased the complexity of the economic problem.

“Nor were these the beliefs and words of cranks”

British economist John Maynard Keynes wrote in 1920 (emphasis and [ ] added):

Lenin was…right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency [i.e. debasement, by inflating the currency supply]…it does it in a manner which not one man in a million is able to diagnose…In the latter stages of the war all the belligerent governments practised…what a Bolshevist might have done from design. Even now…most of them continue...The inflationism of the currency systems of Europe has proceeded to extraordinary lengths...

Before concluding (emphasis added).

If…a government…allows matters to take their course…the worthlessness of the money becomes apparent, and the fraud upon the public can be concealed no longer.

Keynes, J.M., The Economic Consequences of the Peace, (1920) pp 236-240.

President of the Genoa Conference’s Financial Commission, British politician Sir Laming Worthington-Evans, also identified the ultimate cause of the global economic turmoil (emphasis added).

So long as an indefinite increase in the amount of currency is possible there can be no stable value ; it is therefore essential that the output of the printing press should be limited, and that the annual expenditure of every State should be balanced by taxation.

Saxon Mills, J., The Genoa Conference, Hutchinson & Co. London (1922) p 151.

By 1925 the League of Nations was reporting that in most countries “direct inflation of currency through the agency of central banks had ceased…hyper-inflation had completely ceased.“ It wasn’t true, the League was dissembling. Maybe it had ceased through the “agency of central banks,“ but debt/currency was still being created in vast quantities—by private banks and governments (using their Treasuries). Quotes from Memorandum on Currency and Central Banks, League of Nations, Geneva (1925) p 15.

Prominent Austrian economist Ludwig von Mises, living in the midst of the European economic collapse, recognised in 1928 that ([ ] added):

The first condition of any monetary reform is to halt the printing presses [and stop] financing government deficits by issuing notes, directly or indirectly.

Though he was referring to Germany, most governments globally had been doing the same. Mises showed that purchasing-power cannot be measured; it’s not a ‘thing.’ Therefore

There is no such thing as “stable” purchasing power, and never can be. The concept of “stable value” is vague and indistinct. Strictly speaking, only an economy in the final state of rest—where all prices remain unchanged—can have a money with fixed purchasing power.

von Mises, L., Monetary Stabilization and Cyclical Policy, published in 1928 in German. Translated quote from von Mises, L., The Causes of the Economic Crisis and Other Essays Before and After the Great Depression, The Ludwig von Mises Institute, Auburn (2006) p 14.

“purchasing-power cannot be measured“

ibid p 72.

It’s unlikely Mises’ work had reached the English speaking world by 1930, when the Treasury and Niemeyer made their opening moves. Not that it would have mattered. Powerful international bankers had their own monetary reform in mind and it was clear they didn’t want to repair the broken system; they had been ignoring the root cause, “the printing presses,“ for the past decade.

“It’s unlikely Mises’ work”

Mises was published in German so it’s unlikely English speaking economists were aware of his thinking in 1930. Even if they were it probably wouldn’t have mattered. The west was in the grip of academic theorists like John Maynard Keynes who proposed that more government spending, wage inflation and oppressive domestic price regulation could somehow be reconciled* and relieve the worst aspects of recession/depression. And the best source of funding** was debt. Politicians loved this idea because they didn’t have to first go to the public to get money. They just borrowed it, and later extracted from the taxpayer to pay. No doubt bankers loved it too.***

The economist who accompanied Niemeyer to New Zealand, Professor Theodor Gregory from the University of London, was a contemporary of Keynes in Britain.

“for the past decade“

Bankers had been testing their ideas**** and galvanizing their intellectual weaponry with the aim of re-engineering global currencies away from commodity-backed (i.e. gold and or silver) hard-money into an immensely more profitable interest-bearing debt-based currency system. More on this later.

* ”somehow be reconciled”

These interventions were all a disaster with the end result being the Great Depression followed by World War 2.

** “best source of funding“

Because it was immediately available.

*** “bankers loved it too“

Maybe it was because of this that Keynes’ ideas dominated?

**** “testing their ideas“

Using the League of Nations’ Financial Committee, of which Niemeyer was a member: for example, the decimation of Austrian and Hungarian societies post WW1.

“which was unequivocal“

There was agreement across all schools of economic thought on the cause, which was the currency debasement in most countries resulting from the war; debasements by various mechanisms, but ‘money printing’ all the same. And there had been no success in trying to establish stable value between them.* There was no agreement on the solution.

* There were other complicating factors (e.g. U.S. protectionism) but all rooted in the disturbances caused by ‘money printing’ during- and post-war.

“manifested in New Zealand“

Although New Zealand was economically irrelevant in a global context, as an important supplier to Britain what happened there profoundly effected it; New Zealand used British currency, sold most of its exports to Britain, and all its foreign trade was settled in London. A combination of…

massively increased British debt which inflated their currency 4-fold,

the flawed reconnection of sterling to gold in 1925,

British unemployment of over 2 million which helped cripple New Zealand’s exports,

the inflated exchange rate with Britain which had decapitated New Zealand’s purchasing power, and

the protectionist stance many countries took after the war which exacerbated the global trade problem,

…all conspired to produce the complexity of effects seen in New Zealand.

The problem being experienced in New Zealand and around the world was the instability of value* of global currencies which itself was a consequence of this currency inflation. Inflation which, as well as being based on interest bearing debt, had produced no actual value**. But the people who possessed the new currency expected to be able to use it. Therefore the only place the newly created currency could obtain value from was stealing it from existing currency.

“President of the Genoa Conference’s Financial Commission“

British politician Sir Laming Worthington-Evans,

* “instability of value“

Globally, at different times and different rates, and depending on the country, there was accelerating consumer price inflation, export price deflation, production deflation, increased interest rates, increased import tariffs…essentially economic turmoil everywhere. It was proving difficult to arrive at any price discovery for international trade because no-one knew the value of the currencies. Which is why the 1920 International Financial and 1922 Genoa conference reports mentioned gold at least 94 times between them (19+75 respectively). And the 1927 World Economic Conference’s supporting documents at least 1600 times.

** “produced no actual value“

The new currency was used to fund war. So by 1918 there was all this extra currency and nothing to show for it. Apart from millions dead and massive destruction.

A search of Papers Past reveals zero results for the phrase “money printing” between 1 Jan 1914 and 31 Dec 1930.

“the press or politicians“

Though the bankers would have been intimately familiar with the conferences’ the politicians and press should at least have had high awareness. All the financial conferences were covered extensively in the newspapers.

A search of Papers Past returned the following item counts between the year of the event and the end of 1930:

1920 ”Brussels Conference”—888

1922 ”Genoa Conference” > 5900

1923 ”Imperial Conference” > 9000 (1923 only because of multiple conferences)

1927 ”World Economic Conference” — 333

“proximate effects”

Mainly the high exchange-rate and the four Australian owned banks. These will be covered later.

“meaningful international trade“

When Britain returned to a gold standard the Federal Reserve Bulletin noted (emphasis added):

Thus the resumption of gold payments by the chief trading countries of the world furnishes a basis for the functioning of those forces which before the war operated to maintain a close contact between the money markets of the world…Federal Reserve Bulletin, Vol. 11 No. 6, June 1925, p 369.

The United States accounted for about 22% of global exports in 1921 declining to 13% ten years later. But this decline in percentage of global exports was at a time when the U.S. dollar value of global trade was generally increasing, so the dollar value of U.S. exports was increasing for most of that period. Source: United Nations Department of Economic and Social Affairs, Statistics.

“Gold was the only alternative on the table“

The three League of Nations’ conferences combined reports mention gold at least 94 times. But the 1927 conference had an ancillary document, the Memorandum on Currency and Central Banks 1913-1924, which mentioned gold over 1600 times. It stated (p 6) “By the middle of 1925…there were…thirty countries whose currencies were…based on gold.”

“In 1925“

In 1924 the British established a five member Currency Committee, three of whom were bankers, including Niemeyer. The Committee, reduced to four when its report was published, recommended the return of sterling to a gold standard, and the gold-sterling exchange-rate to be used. The success or failure of the renewed British gold standard hinged solely on the gold-sterling exchange-rate. For more…

https://craighutchinson.substack.com/p/part-4c-19301931-a-new-zealand-central#footnote-5-142348208

While the Committee considered the “return to the gold standard on the basis of a devalued sovereign” it “wasn’t seriously considered. It was never…a policy which the United Kingdom could have adopted.“ In 1925 sterling went back on a gold standard. The British chose an exchange-rate which not only guaranteed the eventual failure of their gold standard, it created conditions which severely aggravated the effects of the depression in New Zealand. The exchange rate was overvalued. Quotes from Federal Reserve Bulletin, Vol. 11 No. 6, June 1925, p 376.

There was no public explanation given by the Committee why “a devalued sovereign was never…a policy which the United Kingdom could have adopted,” but the reason was obvious. Greed. The bankers were trying to protect the ‘value’ of the sterling they had been furiously ‘printing’ for over a decade.

Prominent economist John Maynard Keynes identified the problem at the time:

The policy of improving the foreign-exchange value of sterling up to its pre-war value in gold from being about 10 per cent below it, means that, whenever we sell anything abroad, either the foreign buyer has to pay 10 per cent more in his money or we have to accept 10 per cent less in our money. That is to say, we have to reduce our sterling prices, for coal or iron or shipping freights or whatever it may be, by 10 per cent in order to be on a competitive level, unless prices rise elsewhere. Thus the policy of improving the exchange by 10 per cent involves a reduction of 10 per cent in the sterling receipts of our export industries…THE ECONOMIC CONSEQUENCES OF MR CHURCHILL (1925)

Nor did the committee even mean a “sovereign.” Sovereign was the name (a proper noun) for the specie coin of a specific weight of gold. A sovereign has a value of £1 in sterling currency, which the committee (being ¾ bankers at this point) create. The committee was not wanting to devalue their product, the pound sterling. They couldn’t devalue the sovereign. It got its value from the gold content—and gold has no value, gold is the value.

“sterling-gold exchange rate…overvalued“

Britain returned to a gold standard at the pre-war sterling-gold exchange rate, when £1, whether as a note or as a ledger entry, had been a receipt for a gold sovereign, 0.2354 troy ounces of pure gold. The U.S. gold price at the time averaged ~USD$20.75 per troy ounce.

i.e. £1 = 0.2354 ounce of gold; US$20.75 = 1 ounce of gold = 1/0.2354 = £4.25 = £4 5s

So £1 = 20.75/4.25 = $4.88*

Britain had created over £6 billion of debt to fund World War One and expended much of its pre-existing precious metal treasure in the process. By returning to the gold standard at the pre-war rate the British were in effect ‘creating’ gold where none existed. To hide this fact, to avoid devaluing their expanded currency, Britain had to use severe domestic financial austerity including deflation of the currency supply, and all sorts of financial trickery** in their failed attempt to make it work.

“matter of time“

Britain was forced off its gold standard in November 1931.

* the U.S.-sterling exchange-rate in Jan 1925, before the return to a gold standard, was quoted at £1 = $4.86, Gold prices during this period here https://craighutchinson.substack.com/i/142348208/gold-price

** “financial trickery“

As well as “adequate gold reserves”—an arbitrary and meaningless concept unless it is a 100% backed currency—Britain and the New York Federal Reserve used a range of debt instruments as they attempted to get the overvalued sterling to work. For example it had credit facilities with the U.S. totaling $300 million which “should be used only after a considerable amount of gold had actually been exported”…Federal Reserve Bulletin, Vol. 11 No. 6, June 1925, pp 371-2.

“Bankers and their economists argued“

Supported by the press e.g. WAIPA POST, 11 DECEMBER 1930, PAGE 5

The reason for this world-wide depression was attributable to three main causes, namely (1) the shortage of gold; (2) the restricted purchasing power of 25 per cent of the world’s population; and (3) the adoption of exclusion tariffs by certain countries. The world supply of gold was estimated at £2,200,000,000. Of this the United States and France between them had £1,200,000,000. It was the policy of the United States to export as much as possible, and so force settlement in gold. France had reduced wages by inflation, and was exporting large quantities of French goods and requiring settlement in gold.

Others argued differently. Correctly in my opinion. From the perspective of the bankers there was not enough gold at the price they wanted to ‘value’ their ‘printed’ currencies against. But there is always enough gold. See von Mises, L., Monetary Stabilization and Cyclical Policy, published in 1928 in German. Translated quote from von Mises, L., The Causes of the Economic Crisis and Other Essays Before and After the Great Depression, The Ludwig von Mises Institute, Auburn (2006) p 19-20.

“Some of that value had already been extracted“

The next source of value was to be future taxpayers. More on this later.

“Niemeyer…would have had intimate foreknowledge“

As one of the four or five most senior staff of the Bank of England and one of the five members of the Currency Committee, Niemeyer would have certainly known the British gold standard was never going to hold; that sterling was over-valued.

Both Parks and Ashwin at the very least should have known. This is basic mathematics. And psychology; something (currency) can’t be created out of nothing and be expected to have the same value as the thing it’s meant to represent (gold).

“key reason New Zealand’s“

Of course New Zealand would not have escaped the consequences of the global monetary expansion justified by the war/post-war, but by delaying the inevitable devaluation of sterling, and instead further expanding the currency supply, Britain made the ravages of the inevitable collapse worse for itself and all its ‘Dominions’ and colonies that used—or whose currencies were fixed to—sterling.

“never part of the public narrative“

When Niemeyer’s report landed on the Prime Minister’s desk sterling only had a few months left on the gold standard. It is not credible to believe Park, Ashwin, and other senior Treasury officials were unaware of the state of the sterling gold standard.

“They were in fact profound“

The simplest way to explain this is to use a crude, but very appropriate, analogy. The bankers were selling a solid looking building they were saying was constructed on a foundation of granite. But not only was the building not solid, it was built on quicksand, and the bankers knew it. Because they had constructed and located it. Collapse was inevitable, which the bankers also knew. And because they were the only ones who did, they were the ones who would profit.

Why? Because in finance the most important factor…the variable that matters the most…is timing.

And to think, all this power creation, giving psychopaths the power to buy things and People to Their nefarious aims (which all energy accounting will allow) is archaic. We can free Humanity from psychopaths in control with free energy tech They hide and suppress.

Electrogravitics: Gravity Control & Energy from the Aether (9 min): https://odysee.com/@amaterasusolar:8/electrogravitics-gravity-control-energy:6?lid=eeff9e0c80138ce03e22d76bcd5f2f873ff46b72