NZ Financial Resets: Part 4c: 1930/1931 - A Prussian's Wiles

Treasury's balloon gets some British helium

“It is time that New Zealand came into line with other civilised countries and put her monetary system on a permanent and scientific basis“ - DOMINION, 4 SEPTEMBER 1930, PAGE 8 - CURRENCY AND EXCHANGE PROBLEMS

Previous: 1930 - Treasury Beguiles

Next: Treasury Beguiles and A Prussian's Wiles: An Orchestrated Litany of Lies - #1 & #2

Home: New Zealand’s Financial Resets

Otto Niemeyer

The second publicly significant personality in the evolution of New Zealand’s central bank was a senior Bank of England official, Sir Otto Niemeyer. While Bernard Ashwin initially fronted the New Zealand end of the Treasury’s drive for a central bank, it’s probable the Treasury as an institution, which Ashwin would soon head, was under the instruction of Niemeyer, the Bank of England and/or HM Treasury.1

Despite his knighthood, importance and obvious influence there was little publicly available information about Niemeyer. He was a mysterious personality with an opaque personal history; he didn’t even appear to have a formal job title despite his obviously very senior role at the Bank of England. Nearly a century later little has changed and reliable publicly available background information of any depth on Niemeyer is scarce.2

The son of a Prussian Hanoverian father and English mother, Niemeyer’s family was prosperous enough to ensue he received an elite education. He was either very well connected or a brilliant man. Though he won a position at HM Treasury in “open competition” there is nothing to indicate brilliance. Aside from his stellar career.3

Niemeyer began his career at HM Treasury in 1906, aged 23. Within five years he was promoted to one of the plumb jobs for his paygrade, Private Secretary to the Financial Secretary. He had further rapid promotion and in 1922 at the young age of 38 Niemeyer became Controller of Finance. A powerful post at the centre of the British establishment.

In that year Niemeyer became a member of the Financial Committee of the League of Nations and had served continuously, including a term as chairman. He must have known American Theodore Marburg, who we met earlier as a prominent advocate for the League. This links our story to

‘s Prussiagate series.4In 1923 Niemeyer was selected as one of five members of HM Treasury’s Committee on the Currency and Bank of England Note Issues, whose report led to the Gold Standard Act 1925 and the return of Britain to the gold standard. Recruited to the Bank of England in 1927 as an advisor to Governor Montague Norman, he was elected as an Executive Director in 1938. In 1931 Niemeyer became a Director of the Bank for International Settlements, serving as Chairman from May 1937 – May 1940.5

Less than a week after Bernard Ashwin’s 5 June speech the press announced that Niemeyer was intending to visit Australia to advise on banking reforms. New Zealand Prime Minister George Forbes told the Parliament in early July that he hoped to announce Niemeyer’s visit to New Zealand, which was also considering banking reforms. Fortuitously Niemeyer was available and arrived in Wellington in early September.6

He was met at the dock by Ashwin’s boss, Secretary of the Treasury Alexander Park. Niemeyer stayed for two weeks; he met with the Government Executive, the Treasury and representatives of the six banks, travelled to the tourist resorts of Rotorua and Mt. Cook, spoke at the New Zealand Club and departed. The visits to Rotorua and Mt. Cook must have consumed at least half his time and, as he was accompanied by Alexander Park on both trips, this is likely when most of the real business was done.7

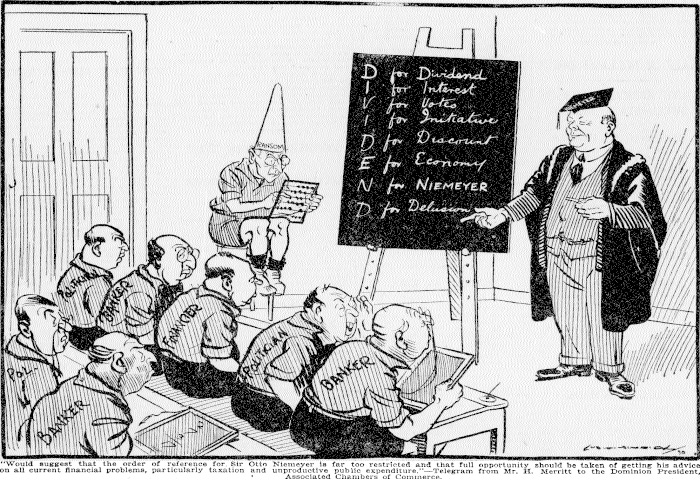

The press made an event of Niemeyer’s visit and the coverage was extensive. They seemed in thrall to the “exceptionally qualified high official of the Bank of England” and his every public utterance was reported widely. It’s hard to know if this was a consequence of naïveté or cynicism.8

Either way, a narrative was being created.

Even advertisers used his words (or perhaps invented them).

That narrative was pushed further as the capital’s population was primed for Niemeyer’s imminent arrival. The day after he departed Sydney, Wellington’s Dominion newspaper published an editorial which nearly a century later looks like crude propaganda. Using a mix of decontextualized claims, half-truths and factual inaccuracies, false juxtaposition and cultural cringe it left no doubt where it stood (italics and [ ] added).9

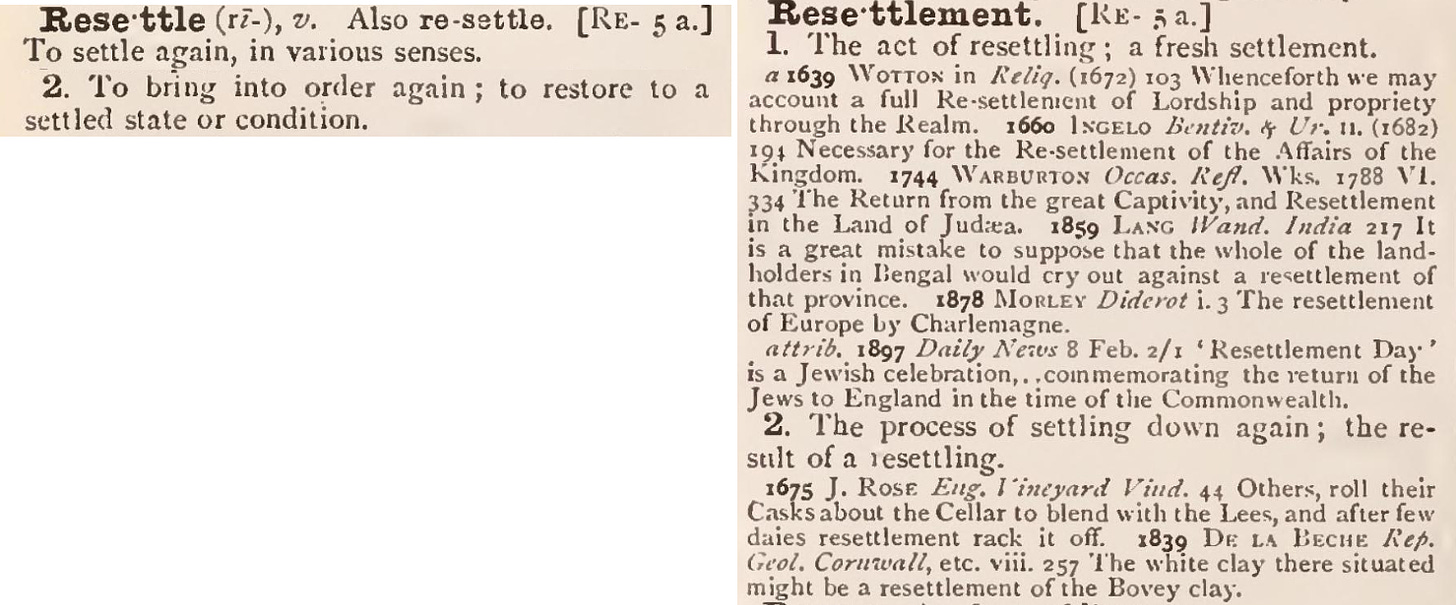

…A resettlement10 of the currency system…has long been overdue. It is time that New Zealand came into line with other civilised countries and put her monetary system on a permanent and scientific basis…

The opening for inflation of the note issue, under existing legislation, is therefore practically unlimited…

An alternative and simpler arrangement [than returning to the gold standard] would be to provide that the banks shall be required on demand to provide sterling…11

Was the Dominion speaking for the government, the Treasury, or the local banks (italics added)?

…the development of a central bank for the Dominion, a step which we consider premature. There is also the question as to whether our local gold reserves are not wastefully large and could not be employed, in part at least, to better advantage in London. On this point, however, the last word must be left to the banks themselves. They are the owners of the gold, and can quite properly regard its disposal as their own business.

Given bankers were “known to be strongly in favour of the proposal,” but kept their opinions “screened from the spot light of publicity” maybe in this instance the Dominion was speaking for the local banks.12

Coincident with Niemeyer’s departure from Australia, the Christchurch Press ran a 1400 word article Wobbling Money written anonymously by ANF. The day after he arrived in New Zealand an expanded version, now over 5000 words, appeared in the Dominion, serialised over three sequential days. The opening sentence, repeated in both newspapers, revealed these papers were no-longer mincing words to their readers about the global nature of the unfolding economic catastrophe.13

the present world-wide fall in commodity prices which has brought Australia to the verge of bankruptcy, and is leaving a trail of disaster and depression around the whole globe

The word depression in this context is an economic term defined by statistics, which are only available after the event. By 1930 the economic situation had been clearly apparent to the population for several years.14

*********

Otto Niemeyer the banker was being hailed in the press as the keeper of the intellectual solution for the Dominion and the Empire to a problem broadly known as the Depression. A Depression caused by that same class of men. Bankers. A Depression caused by what the press appropriately called wobbling money. A Depression that Niemeyer had personally had a role in aggravating, as a significant bit-player in the creation of the wobbling money.15

The Wobbling Money series was an important element in the intellectual ammunition used to complicate and obfuscate the issues around what was happening to money and why;

it was not reprinted anywhere else in New Zealand and was clearly targeted at the nation’s political and bureaucratic/managerial class as a narrative template

it including a ‘dictionary’ of ad-hominem attack language,

it was part of an intensive nationwide propaganda campaign, ramped up around Niemeyer’s visit, used to support a narrative that shifted blame for causing the depression from the bankers responsible to a narrative that resulted in bankers increasing their power.

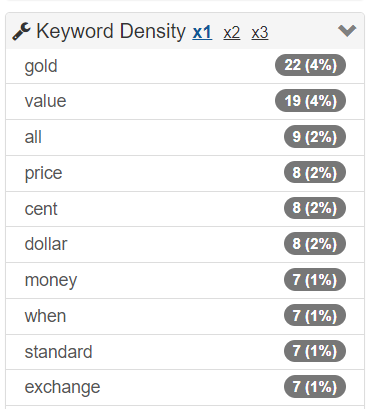

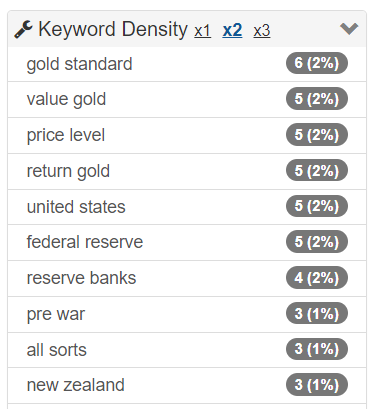

The propaganda campaign that was used to support a central bank and attack opponents will be examined later; suffice to say for now the most frequently used word in both the short and long versions of Wobbling Money was

gold.16

Ironically the expert neo-classical economist who provided the intellectual weight ANF relied on to solve the problem of "wobbling money”, Yale University’s Professor of Political Economy Irving Fisher, was already a year into his journey to penury in consequence of the previous year’s stock market crash.17

On 11 September the Auckland Sun, still silent on Bernard Ashwin’s Treasury role, linked his 5 June speech with Niemeyer’s visit.18

IMPORTANT changes in New Zealand’s banking laws, primarily by legislating to fix the sterling exchange standard in the Dominion, advocated recently by a prominent accountant, Mr. B. C. Ashwin, is of absorbing interest at present because Sir Otto Niemeyer, Bank of England finance expert, is now here investigating the Dominion’s banking problems…SUN (AUCKLAND), 11 SEPTEMBER 1930, PAGE 8

The day before he departed Niemeyer gave a speech, likely written with the Treasury’s input, to members of the New Zealand Club in Wellington. Attendees included the Acting-Prime Minister E.A. Ransom who, in the Prime Minister’s absence, would already have been well briefed on Niemeyer’s views. His presence wasn’t required for diplomatic reasons as Niemeyer was low status by this measure. What did Niemeyer say that attracted the presence of the acting head of government?19

*********

It appears this speech was intended to serve multiple purposes;

to re-emphasize the war as the root cause of the world’s economic problems, and that New Zealand’s problems could only be solved as part of an international effort led by the League of Nations,

to lobby for a central bank for New Zealand, and

to further debase gold and ensure it remained a “barbarous relic."20

If the press reports are accurate, Niemeyer continuously dissembles to make his case. After some opening remarks, including possibly his only truly honest words, he makes an extraordinary statement, given there had been only one world war at that point.21

Every war tends to become a world war

The rest of Niemeyer’s speech dealt with the “economic problem,” which could only be solved, he repeatedly claimed in one way or another “by international agreement and international action“ using international institutions which “New Zealand cannot in her own interests stand aside from.” This was the route to “order and tranquility.”22

He gave as a “completely successful” example the brutal Austrian post-war “experiment” of economic repression instituted by the League of Nation’s Financial Committee, of which Niemeyer was a core member. Part of the solution required the “growing co-operation between the central banks.” Which New Zealand didn’t have at that point. It’s clear one of his aims was to change this.23

Niemeyer used tricks of language and mathematics to shift responsibility for the global “economic problem.” Blaming the war as the reason all the currencies of Europe were “deprived of any value“ he carefully omitted Britain from his list of collapsing currencies, even though he must have known how unstable sterling was.24

Ultimately there was a reason for the “wobbling money” and it had an unspoken name.

Debasement

Sixteen years of monetary debasement through almost continuous ‘printing’ had resulted in most of the currency being backed by debt instead of gold. Debt justified by war and due to be repaid by the population. This shift in the currency’s backing was only politically achievable using the cover of war. The war had allowed the currency to be moved from a commodity based system, which restrained its growth and measured its value in commodities, into a financialized debt based system, which allowed currency to grow....and grow almost without the restraint. And where did the ‘value’ of this debt based currency derive from? Future taxation.25

At the conclusion of his address, Sir Otto Niemeyer was accorded a vote of thanks and was presented with a memento in the form of a silver kiwi mounted on greenstone…PRESS, 25 SEPTEMBER 1930, PAGE 1126

Though Niemeyer’s visit continued to ripple in the press for months afterwards, and he remained an advisor to the New Zealand Government on “questions of banking, currency, and exchange,“ the next significant event was his report which landed on the Prime Minister’s desk a few months later.27

The Niemeyer Report - Banking and Currency in New Zealand (1931)

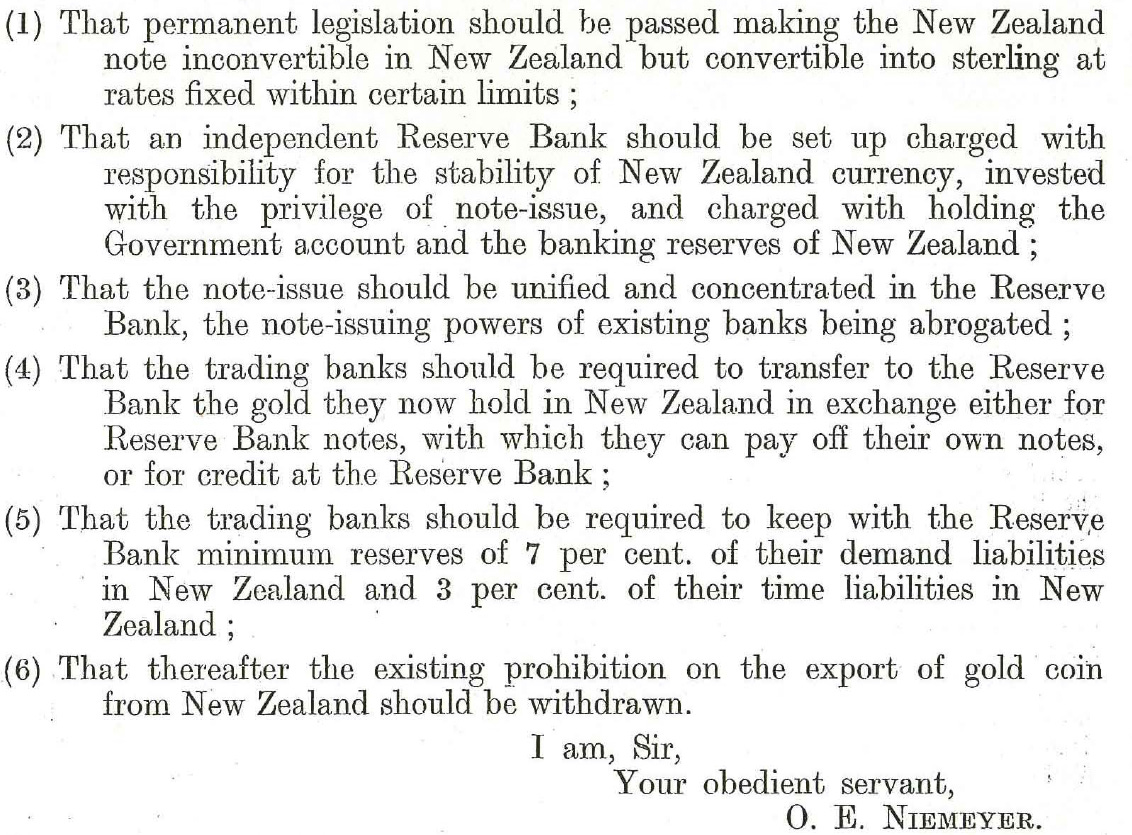

Niemeyer’s twelve page report, Banking and Currency in New Zealand, was handed to the Prime Minister in February 1931. Considering its implications, the report seems small. The first five pages, in the form of a letter addressed to the Prime Minister, outlined his proposal. However (emphasis added)

To avoid overloading the report with a multitude of matters…I have put my detailed suggestions for carrying out the proposals…in the form of draft statutes modelled on the lines of general central banking legislation, with such modifications as seem indicated in the circumstances of New Zealand.28

Draft statutes. The gall of the man from the Bank of England. There’s not much more to add. Niemeyer had six recommendations

Boiled down to essence Niemeyer’s report revealed no surprises though it did re-emphasise how badly the London bankers wanted gold out of circulation in New Zealand, out of the hands of the Australian banks, and under the control of London.29

In summary, Niemeyer recommended (i.e. wanted):

a new privately owned and controlled central bank in New Zealand (to be called the Reserve Bank),

the Reserve Bank to have the sole right to issue banknotes, which would be legal tender,

gold completely removed as a factor in New Zealand domestic banking. Acknowledging the ‘temporary’ nature of the laws making bank notes inconvertible to gold, he “strongly recommend[ed] permanent legislation.”

all gold holdings of the six private banks transferred to the new Reserve Bank and the restriction on the export of gold removed.

the Reserve Bank to be able to purchase Government Securities (Treasury bills) maturing within three months.

This final point, the central bank being able to purchase Government Securities, was very important to the bankers. Not only would it ensure a buyer for the Treasury’s bonds, but, all things being equal, it would increase the value of the bonds because there would now be a ‘lender of last resort.’

Gold gets sixty-four mentions in Niemeyer’s report, including this one which, like the writer of the 4 September 1930 Dominion editorial, appeals to a cultural cringe element the British reserved for ‘her’ dominions (emphasis added).30

An internal gold circulation is not merely an unnecessary luxury from the point of view of New Zealand, but also would be contrary to modern views on currency…

As if Niemeyer would know what was best from the “point of view of New Zealand“. He would certainly have been aware of banker J.P. Morgan’s testimony to the U.S. Congress’ Banking and Currency Committee eighteen years earlier when Morgan said “Money is gold. Nothing else.”31

The proposed “draft statues” constitute the remaining seven pages. And they were “detailed”, right down to the ‘suggested’ name of the new central bank. What the “lines of general central banking legislation” were, which Niemeyer’s report said were the templates for these draft laws, was never elucidated.32

By June 1931 Prime Minister George Forbes had decided “that the present time was not regarded as opportune for making legislative experiments“ and decided not to introduce legislation along the lines of Niemeyer’s report. Though there were some complaints that the delay “left the subject hanging in the air” this was far from the truth. Battle lines were drawn. Many New Zealanders were not prepared to accept the proposed changes without a fight.33

The next parts will examine the validity of claims used to justify Treasury’s and Niemeyer’s proposals, and the response from the public, politicians, and banks.

See full texts of some of the documents used in Part 4.

Previous: 1930 - Treasury Beguiles

Next: Treasury Beguiles and A Prussian's Wiles: An Orchestrated Litany of Lies - #1 & #2

Home: New Zealand’s Financial Resets

APPENDIX 1

What is Currency? A Short Summary.

Currency is supposed to be the most liquid commodity. It’s liquid because everyone in a society accepts it to settle debt - the commodity has currency with everyone because it flows and circulates readily between people. It has currency because it is desired. Until 1914 the commodity most commonly used as currency around the world was gold, silver being used to divide gold. Most world currencies divided using a ratio in the order of 15/1 i.e. 15 silver = 1 gold by weight.34

A bank gave customers notes as receipts from the bank for your gold, which they stored for a fee. That is, a bank’s notes were backed by gold. Because these banknotes were receipts, their growth was constrained by the possession of gold. No gold - no note.

Gold (and silver) was also used to back debt. No gold/silver, no debt. But the debtor didn’t need the gold. The creditor (the bank) needed the gold. The creditor was lending the gold, though normally there was no transfer of physical gold. Banks simply created entries in their ledgers. But because this debt was backed by the commodity circulating as currency, gold, the debt could circulate as currency. No problem.

Then banks wanted to be able to create notes backed by nothing; no gold or any other commodity. But currency needs to be backed by something. Slowly, over a century, the ‘commodity’ that backed currency was incrementally changed until it came to be backed by nothing except future taxes.* Big problem. And here we are.

* I would argue that because the supposed value was dependent on future events happening, there was no real intrinsic value.

APPENDIX 2

Gold price 1924 - 1932

05/01/1924 £4 6/5 BAY OF PLENTY TIMES, 5 JANUARY 1924, PAGE 2

23/09/1924 £4 12/7 HAWKE'S BAY TRIBUNE, 24 SEPTEMBER 1924, PAGE 8

23/10/1924 £4 12/ HAWKE'S BAY TRIBUNE, 25 OCTOBER 1924, PAGE 8

08/12/1924 £4 8/8 HAWKE'S BAY TRIBUNE, 10 DECEMBER 1924, PAGE 8

04/02/1925 £4 6/11 HAWKE'S BAY TRIBUNE, 4 FEBRUARY 1925, PAGE 7

28/05/1925 £4 8/11½ GREY RIVER ARGUS, 28 MAY 1925, PAGE 4

02/01/1926 £4 4/10½ DOMINION, 2 JANUARY 1926, PAGE 10

27/03/1926 £4 4/11½ SOUTHLAND TIMES, 27 MARCH 1926, PAGE 2

25/09/1926 £4 4/11 EVENING POST, 25 NOVEMBER 1926, PAGE 9

17/08/1927 £4 4/11½ SUN (AUCKLAND), 17 JUNE 1927, PAGE 2

28/09/1927 £4 4/11 EVENING POST, 28 SEPTEMBER 1927, PAGE 12

03/01/1928 £4 4/11 SOUTHLAND TIMES, 3 JANUARY 1928, PAGE 2

09/06/1928 £4 4/10¾ NEW ZEALAND HERALD, 9 JUNE 1928, PAGE 9

14/09/1928 £4 4/11½ EVENING POST, 14 SEPTEMBER 1928, PAGE 12

05/01/1929 £4 4/11¼ EVENING POST, 5 JANUARY 1929, PAGE 10

06/12/1929 £4 4/11½ NEW ZEALAND HERALD, 6 DECEMBER 1929, PAGE 9

02/01/1930 £4 4/10 AUCKLAND STAR, 2 JANUARY 1930, PAGE 5

27/06/1930 £4 4/11¼ NEW ZEALAND HERALD, 27 JUNE 1930, PAGE 9

02/01/1931 £4 3/1⅜ NEW ZEALAND HERALD, 2 JANUARY 1931, PAGE 5

20/08/1931 £4 4/11¾ AUCKLAND STAR, 20 AUGUST 1931, PAGE 4

09/07/1931 £4 4/10¾ NEW ZEALAND HERALD, 9 JULY 1931, PAGE 9

10/09/1931 £4 4/9¾ EVENING STAR, 10 SEPTEMBER 1931, PAGE 7

23/09/1931 £4 4/9¾ GISBORNE TIMES, 23 SEPTEMBER 1931, PAGE 5

25/09/1931 £5 3/6 NELSON EVENING MAIL, 25 SEPTEMBER 1931, PAGE 5

26/10/1931 £5 5/8 NEW ZEALAND HERALD, 26 OCTOBER 1931, PAGE 5

03/11/1931 £5 8/2 EVENING STAR, ISSUE 20940, 3 NOVEMBER 1931, PAGE 10

31/12/1931 £6 0/8 AUCKLAND STAR, 31 DECEMBER 1931, PAGE 4

01/02/1932 £5 19/7 EVENING STAR, ISSUE 21015, 1 FEBRUARY 1932, PAGE 7

05/01/1933 £6 3/8 NEW ZEALAND HERALD, 5 JANUARY 1933, PAGE 3

09/02/1933 £6 0/2 DOMINION, 11 FEBRUARY 1933, PAGE 14

Irrelevant aside—there was an Otto Niemeyer, a generation younger than our Otto, who was a German fighter ace in World War Two.

“Bernard Ashwin initially fronted”

“under the instruction of Niemeyer“

Treasury was in actuality an extension of the London banks.* It was Treasury’s job to sell government bonds (= debt), a profitable business for the purchasing banks,** and Treasury was responsible for ensuring their payment schedule was met (i.e. mainly paid by taxes). Though New Zealand banks bought most of these bonds,*** not only were London banks also buyers, all the New Zealand banks had a large portion of their capital kept in London because all New Zealand’s foreign trade was settled in London.

Treasury would be the biggest winner with the creation of a central bank because they would ensure a “lender of last resort” for their only product, debt. And not only would the ‘value’ of this debt increase in consequence, but this debt would now be used as security for circulating ‘banknotes.’

“Ashwin would soon head“

Ashwin became Secretary in 1939 and retired in 1955.

*In this essay the words ‘Treasury’ and ‘Niemeyer’ can be considered interchangeable with ‘the London banks’. The Australian banks operating in New Zealand would benefit from only some of what eventuated. Others from the period might have agreed with at least some of this analysis. ([ ] added).

“I think [Niemeyer] has been sent to Australia by the Bank of England to inquire on behalf of other banks…[as to] its stability as a debtor nation to those banks and to advise the Government what to do to maintain that stability”…Mr. H. Goodwin, a “well known commercial man…located in Sydney” - STRATFORD EVENING POST, 3 OCTOBER 1930, PAGE 4

** Not only did banks receive a commission if they on-sold the bonds, if they held on to them the received an income stream, and as a balance sheet asset they could use bonds to create interest bearing debt, a very profitable business.

*** Government bonds had been growing in proportion against gold as an asset on New Zealand banks’ balance sheets since 1914 when the gold standard was abandoned.

“obviously very senior role at the Bank of England“

Almost every reference…has described him in somewhat vague terms, generally as "a high official of the Bank of England.” This, no doubt, is due to the scanty details given of his career…the “Who’s Who” gives his occupation as "at Bank of England since 1927.” "Whitaker’s Peerage” of titled persons is equally as brief, and refers to him as “holding a post in the Bank of England since 1927.” Exactly what position Sir Otto occupies in the bank is therefore, not clear…TIMARU HERALD, 11 SEPTEMBER 1930, PAGE 12 - VISIT OF LONDON BANKER.

“received an elite education“

Niemeyer was educated at London’s elite St. Paul's School and Balliol College, University of Oxford.

“in open competition“

TIMARU HERALD, 11 SEPTEMBER 1930, PAGE 12

Aside from this career success, Niemeyer was knighted before turning 40. For no publicly obvious reason; no books, no academic-type papers, no business success, no actual visible achievements.

“member of the Financial Committee“

Niemeyer on the League of Nations Financial Committee - PRESS, 25 SEPTEMBER 1930, PAGE 11

“…who we met earlier…”

Theodore Marburg. See:

Prussiagate: see

Britain never returned to a gold-exchange-standard as gold was never returned to circulation, though it did introduce what was called a ‘gold-standard’.*

“selected as one of five members“

The Committee was chaired by British Cabinet Minister Austin Chamberlain until his resignation** when ex-Permanent Secretary to the Treasury Sir John Bradbury took over as Chair and the Committee reduced to four. Other members were banker Gaspard Farrer (of Barings Bank) and the Professor of Political Economy at the University of Cambridge, Economist Arthur Pigou. That is one politician and ex-Chancellor of the Exchequer, three bankers (a majority) and one economist…JUNE 1925 FEDERAL RESERVE BULLETIN p375.

It appears Niemeyer had more than passive membership role and the aims of the committee may have been hidden from at least one committee member.

When A. C. Pigou was invited by Sir Otto Niemeyer to serve on that Committee, there was no mention of gold…source.

Addendum: 31 May 2024.

“Bank of England in 1927“

The following year Niemeyer was credited for his contribution to an important book*** on central banking which had a foreword (dated 9 Nov. 1927) by Montague Norman, Governor of the Bank of England.

Kisch, C.H. and Elkin, W.A., Central Banks - A Study of the Constitutions of Banks of Issue, with an Analysis of Representative Charters, Macmillan & Co., London, (1928).

* The October 1931 Federal Reserve Bulletin described this as a gold bullion standard because notes could only be redeemed for amounts of not less than 400oz of gold, about US$8000. pp553-554.

** Chamberlain accepted office as Secretary of State for Foreign Affairs.

*** For example it was referred to in a long pro-central bank propaganda piece published in the Dominion newspaper in later 1933…DOMINION, 8 SEPTEMBER 1933, PAGE 6

“George Forbes told the Parliament“

PRESS, 3 JULY 1930, PAGE 9

Apparently the Prime Minister’s invitation was made at the suggestion of the Associated Chambers of Commerce and “other organisations.” I wonder if the Treasury was one of the other organisations?

HOKITIKA GUARDIAN, 5 SEPTEMBER 1930, PAGE 3 - WELLINGTON TOPICS.

TIMARU HERALD, 11 SEPTEMBER 1930, PAGE 12 - VISIT OF LONDON BANKER.

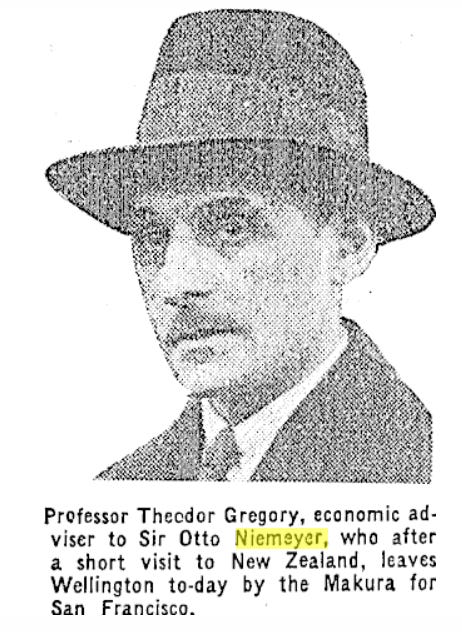

Niemeyer was accompanied by a Rhodes Scholar R. M. Kershaw, Bank of England liaison to the “other banks of the Empire”, and Professor Theodor Gregory from the University of London, who arrived in New Zealand a week before Niemeyer. STRATFORD EVENING POST, 9 SEPTEMBER 1930, PAGE 5

Left: SOUTHLAND TIMES, 9 SEPTEMBER 1930, PAGE 8. Right: National Portrait Gallery. Source.

During his stay Niemeyer was “in constant communication with the Treasury.” HAWKE'S BAY TRIBUNE, 11 SEPTEMBER 1930, PAGE 2

Niemeyer’s party departed on the Maunganui on 25 September for Sydney, Australia. AUCKLAND STAR, 25 SEPTEMBER 1930, PAGE 10

“coverage was extensive“

A search of Past Papers archive for “Niemeyer” between 1 July 1930 and 31 December 1930 returned 2799 results (March 2024). His every step seemed to be reported on. His name was referred to in advertising, and invoked in speeches.

“exceptionally qualified”

POVERTY BAY HERALD, 7 JULY 1930, PAGE 7

“high official of the Bank of England”

HOKITIKA GUARDIAN, 5 AUGUST 1930, PAGE 5

He was variously referred to as a(n): noted financial authority, exceptionally qualified high official of the Bank of England; prominent financier; financial genius; great financial expert; financial physician; famous banker…

It seems Niemeyer’s reputation was also sacrosanct across the Tasman. When Australian politician “Billy” Hughes criticised Niemeyer (beyond the scope of this work) he received much criticism from other politicians, the press, and even the political party he co-founded and led. One of the other co-founders resigned in protest (AUCKLAND SUN,15 SEPTEMBER 1930, PAGE 8).

“The day he departed…”

4 September. FEILDING STAR, 5 SEPTEMBER 1930, PAGE 5

DOMINION, 4 SEPTEMBER 1930, PAGE 8 - CURRENCY AND EXCHANGE PROBLEMS

In 2020s New Zealand the word “resettlement” is rarely seen; in the early 20th century it was common as a search of Past Papers shows. A review of some of the thousands of results indicates it was always used in the context of people. This was the only instance I saw of “resettlement” used in the context of currency. From the 1933 Oxford English Dictionary.

“practically unlimited“

The author of the history of the Australia and New Zealand Bank agreed:

”its effect [making bank notes legal tender]…was to remove all difficulty about domestic cash reserves, since the limits set to any bank’s issue…while real, in practice were not operative restraints.”

Butlin, S.J., Australia and New Zealand Bank = The Bank of Australasia and the Union Bank of Australia Limited 1826-1951, Longmans, Australia (1961) p 359.

The banks’ response will be examined in a later part of this series.

PRESS, 5 SEPTEMBER 1930, PAGE 12 - WOBBLING MONEY *

DOMINION, 9 SEPTEMBER 1930, PAGE 7 - WOBBLING MONEY (Pt 1)

DOMINION, 10 SEPTEMBER 1930, PAGE 9 - (Pt 2)

DOMINION, 11 SEPTEMBER 1930, PAGE 7 - (Pt 3)

Word count using wordcounter.net.

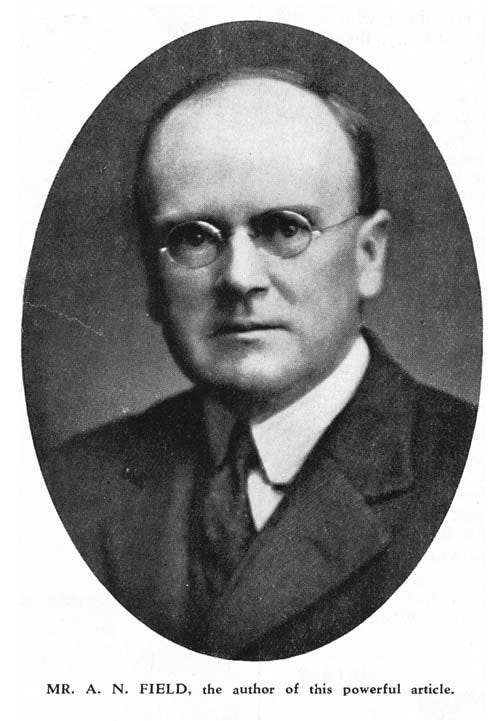

“anonymously by ANF“

It’s likely ANF was A. N. Field who was a regular press contributor on monetary matters over this period. Author of The Truth About The Slump (1934), and All These Things (1936), Field was a controversial character and probably deserves his own biography, rather than the scant and defamatory entry in The Encyclopedia of New Zealand.*

“THE TRUTH ABOUT THE SLUMP”, Otago Daily Times, 30 April 1932, Page 16

For example, Field’s criticism of the proposed Reserve Bank. RESERVE BANK BILL, NELSON EVENING MAIL, 30 JANUARY 1933, PAGE 8.

https://en.wikipedia.org/wiki/A._N._Field

https://teara.govt.nz/en/biographies/4f8/field-arthur-nelson

* This critique needs to be rewritten; the analysis of A.N. Field’s letter is too harsh in my opinion as I’ve found out more about him.

“no-longer mincing words“

This is not to imply the press had not been covering the state of the global economy. An examination of newspapers from the period reveals thousands of articles about the state of trade, the exchange rate, inflation and consumer prices, unemployment…all the expected economic parameters got some coverage in the five years before 1930. However they frequently localised, or downplayed both the extent and depth of the problem, and most often conclude with an unrealistically optimistic and hopeful message given the information available at the time.

“The Depression is part of the folklore of my childhood, a grey and ill-defined monster, an unspeakable disaster…it cast a long shadow, a blight on everything it touched…Memories of wasted years…You wouldn’t understand it unless you saw it, and if you saw it you wouldn’t understand it.“

Simpson, T., The Sugarbag Years, An Oral History of the 1930s Depression in New Zealand, Alister Taylor Ltd., Martinborough (1974) pp 8-9.

”…the problem in New Zealand…began in 1927…” Ibid p 10.

”People think the Depression started about 1929. Well it didn’t…I came out to New Zealand in 1926…[my husband] was an educated man, and he couldn’t get work. There was a lot of unemployment…” Ibid p 15.

“hailed in the press“

Not by everyone agreed. Dissenting voices will be examined in a later part of this series.

“partially responsible”

The “wobbling money” being experienced then was in part a consequence of the reintroduction of the gold standard. Niemeyer was one of the five committee members of the Currency Committee who’s report let to the reintroduction of the gold standard. More on this later.

Analysis done using wordcounter.net

PRESS, 5 SEPTEMBER 1930, PAGE 12 - WOBBLING MONEY

DOMINION, 9 SEPTEMBER 1930, PAGE 7 - WOBBLING MONEY (Pt 1)

DOMINION, 10 SEPTEMBER 1930, PAGE 9 - (Pt 2)

DOMINION, 11 SEPTEMBER 1930, PAGE 7 - (Pt 3)

Fisher is quoted in the New York Times of 15 October 1929:

Stock prices have reached what looks like a permanently high plateau…I expect to see the stock market a good deal higher within a few months.

Less than two weeks later, on 28 October (aka “Black Monday”), the Dow Jones began it’s precipitous decline which ‘officially’ signaled the beginning of the Depression. Three years later it was down 90%. Irving Fisher, considered one of the greatest neo-classical economists of this day, lost both his reputation and a fortune of over $100 million in 2011 dollars. He only avoided bankruptcy due to assistance of a wealthy relative.

Keen, S., Debunking Economics - The Naked Emperor Dethroned, 2nd ed, Zed Books, London (2011) pp 270-273.

Addendum: Steve Keen’s Substack

In 1927 Fisher had correctly identified one of the key issues affecting New Zealand because of the consequences for Britain ([ ] added).

Europe must pay [the war debt], but when we realise that her payments must be in goods, we [the U.S.] try to shut these out by tariff wall.

Quoted in Chappell, N.M., New Zealand BANKER’S HUNDRED - A History of the BANK OF NEW ZEALAND 1861-1961, Bank of New Zealand, Wellington (1961) p 308.

“silent on Bernard Ashwin’s Treasury role“

Despite Ashwin having already been identified at least once as a Treasury official the past practice of most press, of keeping Ashwin’s identity removed from Treasury, was continued; this time he was “a prominent accountant.” See here for examples of Ashwin’s changing identity.

“likely written with the Treasury’s input”

At least half of Niemeyer’s time in New Zealand was spent in the company of the Secretary of the Treasury Alexander Park as they travelled together by train to and from Rotorua and Mt. Cook.

“Prime Minister’s absence“

Prime Minister George Forbes was sailing to London to attend the Imperial Conference.

Press reports of Niemeyer’s New Zealand Club speech.

PRESS, 25 SEPTEMBER 1930, PAGE 11 - NATIONS OF THE WORLD.

EVENING STAR, 25 SEPTEMBER 1930, PAGE 10 - THE LEAGUE AND GOLD.

MANAWATU STANDARD, 25 SEPTEMBER 1930, PAGE 8 - INTERNATIONAL PROBLEMS

Attributed to British economist John Maynard Keynes.

“only truly honest words“

Niemeyer said “It may seem odd that any representative of the Bank of England should visit New Zealand”. It did seem “odd”, at least to some. Opposition will examined in a later parts of this series. But when you understand that London bankers were the ‘wizard behind the curtain’* who really controlled the New Zealand Government, it is not odd. Niemeyer was just making sure the bankers’ plan, sometimes known as the Milner Group’s (also the Round Table) plan, sometimes called the Marburg Plan, was being carried out.**

* See: Bill Still’s The Secret of Oz.

** I’m of the opinion that, if the individual schemes were initiated separately (and I’m not certain of that), the various conspirators quickly found each other and consolidated their goals.

We know World War One was planned, and slowly advanced, over many decades, and was used to further a multitude of agendas. One of those agendas was to create a global ‘peace movement,’ another was to generate the conditions which would allow gold, hence value, to be detached from currency. Both aimed to enhance the power and wealth of one class of co-conspirators, bankers. This is a big topic and requires re-learning of the fake-history that has been taught in the publicly-funded education systems of the west for the last century.

For more:

Richard Grove, Tragedy and Hope (https://tragedyandhope.com/), has looked at this in the context of Carroll Quigley’s (possibly unintended) exposé, Tragedy and Hope.

The intimate papers of Colonel House by Edward Mandell House is a very interesting first hand account of events that led to the formation of the U.S. Federal Reserve System an WW1.

Woodrow Wilson: Discipline of Revolution, a biography of Wilson by Jennings C. Wise (1937), has some insights, especially concerning a little-known but very important individual, Theodore Marburg.

[Addendum: June 2024]

There was obviously suspicion of Niemeyer’s and the London bankers’ motives. Though this is touched on in the press there doesn’t appear to have been a deep analysis. Leader of the Legislative Council Sir James Parr gave clues to some of the issues being discussed in the wider community when the Reserve Bank of New Zealand Bill was read before the Council for the second time.

New Zealanders are always prone, I fear, to regard with grave suspicion any new thing or any novel idea. Furthermore , some of our community is often apt, not only to be suspicious, but to be abusive of sound, new principles, when they are brought forward. Some fantastic ideas have been expressed here about the central bank idea. I have heard it said that it is a cunning conspiracy to bring our banking system under foreign control — an insidious move to enslave the people of the Dominion. Sir Otto Niemeyer has been pictured as the paid agent of a coterie of cruel, merciless, international—generally German Jew-financiers, who are bringing the whole world under their awful sway. I think it is unfortunate, to say the least, that, when we get a man of Sir Otto Niemeyer's eminence across to these Islands to advise us, critics should indulge in coarse personal abuse. Sir Otto Niemeyer is not an enemy to the British Empire or to New Zealand. He was born in England, and he comes of four generations of men of his family born in England,** and, therefore, full British subjects. I have sat, both at Geneva and in London, on important Commissions with Sir Otto Niemeyer as one of the financial advisers to these Commissions. Sir Otto I know to be a Britisher through and through, in his sentiments as loyal to the British Empire and to its best interests as you or I. It is not only, therefore, a poor argument, but it is a false argument to say of this man that he is actuated by base ulterior motives…New Zealand Hansard, Parliamentary Debates, Third Session, Twenty-fourth Parliament, November 1 to December 22, 1933.

* “touched on in the press“

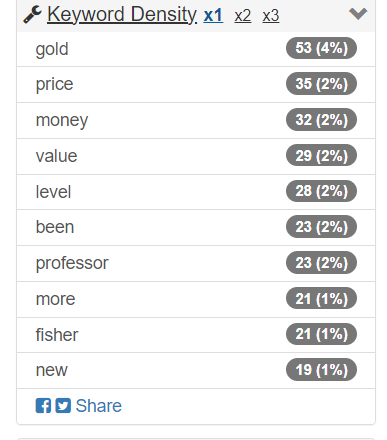

There was varied criticism of the Niemeyer visit. Some saw through the propaganda. Here’s one cynic.

Others worried it would send the wrong signal internationally.

people…are finding fault with the Government for having invited Sir Otto Niemeyer…the fear being expressed that when the outside world learns that Sir Otto has been called in…the general impression will be that this country is in as bad a predicament as that of Australia…PATEA MAIL, VOLUME LI, 12 SEPTEMBER 1930, PAGE 2

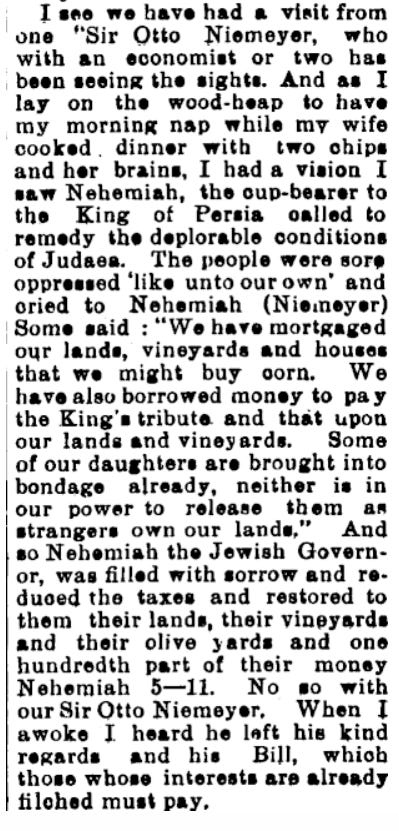

FARMER’S WIFE from Southland made it clear she knew exactly what the implications of the Niemeyer Report were. The Southland Times’ editor’s response gives a sense of ‘elite’ sentiment…a condescending ‘leave it to the “great financial experts and economists” to sort out.’

The “Ed.” was also wrong. There was unanimous agreement from all the experts on the causes of the depression. A “fraud on the public” aka money printing, More here.

** This contradicts Niemeyer’s Wikipedia biography which says his father was an immigrant from Hanover, Germany. If nothing else it reflects the confusion about the background of a man who appeared to have influence over the government.

“using international institutions“

Specifically the League of Nations and the Bank for International Settlements (BIS). Niemeyer had interests in both. He was a prominent member and sometime Chairman of the League of Nations’ Financial Committee, and was soon to become a member of the BIS, an organisation he would eventually lead.

“the brutal Austrian “experiment““

Event’s in Austria after World War One are beyond the scope of this work, but it is a good example of Niemeyer’s ability to dissemble. Because the League of Nations did initially stabilise the Austrian currency crisis* - using gold. But economic conditions worsened as they did globally, and the League’s actions didn’t help Austria. A central bank and new currency were part of this ‘solution’, as was wide spread bankruptcy, persistently high unemployment, and social collapse. But at least the bankers got paid. The League of Nations implemented a solution - “budget equilibrium” - for bankers at the expense of the Austrian people. See here for a general overview:

https://encyclopedia.1914-1918-online.net/article/post-war_economies_austria-hungary

*it was undergoing rapid deflation.

“tricks of language and mathematics“

The language is easy to show, the mathematics seems more difficult for many to grasp. This will be addressed fully in the next part.

“carefully omitted Britain“

Niemeyer said

With the great currency disturbances which have arisen out of the war, disturbances which deprived of any value at all the currencies of Germany and Central Europe, and reduced the value of French and Italian currencies to about one-fifth...

As one of the four or five most senior staff members of the Bank of England, he must have known the true state of the sterling currency, which was so perilous it had a year remaining before it was forced off the gold standard.

See Appendix 1 for a potted explanation of currency.

“repaid by the population“

A population that died in their millions and sacrificed nearly everything in the war. On all sides.

“shift in the currency’s backing“

Niemeyer had a role in these events, initially as a HM Treasury minion, later more significantly. Essentially, the “economic problem” was (in the British case) a consequence of the detachment and reattachment of gold from the pound-sterling currency in 1914 and 1925 respectively. The detachment allowed, and the war excused, the massive currency inflation (aka ‘printing’) seen in the war and post-war years. When it was reattached to gold at the pre-war rate the Depression was a certainty. Niemeyer was one of the five members of the Committee that recommended this.

This was the greatest irony of Niemeyer’s short visit. The man who was touting a valueless product, debt based currency, who wanted to permanently remove the real value backing New Zealand’s currency, gold, was rewarded for his efforts with something that had real value. And if it still exists it will have value today.

“continued to ripple in the press“

A search of Past Papers returns over 2000 results for a search of “Niemeyer” from his departure until the end of 1931. Though these numbers include many reproduced stories they indicate his continued impact on New Zealand, and his name comes up regularly in parliamentary debate.

Aside from his arguments being used immediately to resist wage decreases* the seeds he had planted were germinating.

During the lunch Sir Otto…said…things were becoming less…national and more…international…unemployment…was an international question which concerned the world!…HAWKE'S BAY TRIBUNE, 3 OCTOBER 1930, PAGE 3

Niemeyer’s spirit was evoked to bolster arguments.

MANAWATU STANDARD, 25 OCTOBER 1930, PAGE 8 - GOLD RESERVES

Interviewed in Suva as he journeyed back to Britain, he told the Fiji Times correspondent that “New Zealand will lie quite all right. There is nothing wrong with that country.” Extraordinary.** Some saw the irony.

*EVENING POST, 25 SEPTEMBER 1930, PAGE 10

**ASHBURTON GUARDIAN, 21 NOVEMBER 1930, PAGE 5

“remained an advisor“

EVENING POST, 1 OCTOBER 1930, PAGE 11

The report had the same title as Bernard Ashwin’s 5 June speech, which was also the title of his (Ashwin’s) paper published in The Economic Society of Australia’s publication, the Economic Record in November.

The Niemeyer Report is dated 19 February 1931. In April the Prime Minister George Forbes denied the Government had received the full report.* If the date is correct and reflects when it was delivered to the Prime Minister, he may not have been lying in fact, but he was certainly lying in spirit. By May the press were reporting that though the full Report was not available, it “recommends the formation of a central bank.”** A decision that was “no surprise to those who have followed the trend of banking and currency in other countries during the post-war period.“*** The report was finally tabled in Parliament in early 1932.****

Niemeyer, O., “Banking and Currency in New Zealand”, 1931

https://www.rbnz.govt.nz/hub/publications/guide/1931/otto-niemeyers-1931-report-on-banking-and-currency-in-new-zealand

* HAWKE'S BAY TRIBUNE, 11 APRIL 1931, PAGE 5

** GREY RIVER ARGUS, 12 MAY 1931, PAGE 6

*** OTAGO WITNESS, 12 MAY 1931, PAGE 29

**** “finally tabled in Parliament“

Chappell, N.M., New Zealand BANKER’S HUNDRED - A History of the BANK OF NEW ZEALAND 1861-1961, Bank of New Zealand, Wellington (1961) p 311.

“it is of the utmost importance to economize in the use of gold.”

“scattering of gold about a country in the form of circulating gold coins (or in the form of gold dormant held in private banks) removes that gold from effective influence on the monetary position“

The clue is in the word. Do minion.

Testimony of J.P. Morgan Before the Bank and Currency Committee of the House of Representatives, at Washington D.C. Appointed for the Purpose of Investigating an Alleged Money Trust in “Wall Street”, December 18 and 19, 1912. p 48. Source.

Addendum: 31 May 2024. Niemeyer may have been referring to the Acts and Statutes canvased in this text—he was acknowledged in the Preface for his contribution.

Kisch, C.H. and Elkin, W.A., Central Banks - A Study of the Constitutions of Banks of Issue, with an Analysis of Representative Charters, Macmillan & Co., London, (1928).

“the present time was not regarded as opportune“

ASHBURTON GUARDIAN, 22 JUNE 1931, PAGE 3

“left the subject hanging in the air“

WANGANUI CHRONICLE, 11 JULY 1931, PAGE 14 (SUPPLEMENT)

“society accepts it to settle debt“

But not all debt needs to be, or is, settled with currency. Three examples will suffice, but there are many (how long have you got).

“thanks mum, I owe you“ ; e.g. borrowed the car; may or may not settle in the future — debt, not settled with currency.

”I owe her” ; e.g. she lent me some shoes when I broke a heel; may or may not settle in the future — debt, not settled with currency.

”cheers bro, I owe you” ; he gave me some wild pig he’s shot, he’s coming over for dinner and a few beers, I’m cooking, beers on me; debt settled — debt, not settled with currency.

Otto was the one that enabled the Jews from Germany to transfer their government bonds to all other foreign countries so they could influence governments with bribes and buying up assets until to this day control all sources of food supply, power, fuel, and every other commodity people pay the Jew for, pharmaceuticals, justice systems you name it they control it thanks to Churchill vetoing it!