NZ Financial Resets: Part 4f: 1933: A New Zealand Central Bank - The Prize: A Marxist Theory Applied

And the biggest lie of them all...

“If the devil himself had sought to contrive a machine to absorb the wealth of the people of the world and subjugate them through their poverty, he could not have devised a more perfect one than the central bank reserve system“ — quoted by Captain Harold Rushworth M.P., New Zealand Parliament, Nov. 1933.

“Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency“ — Keynes, J.M., “The Economic Consequences of the Peace”, (1920) p 236.

Previous: Treasury Beguiles and A Prussian's Wiles: An Orchestrated Litany of Lies - #3 and #4

Home: New Zealand’s Financial Resets

Prologue

Recommended reading.

Gold — A Dead Asset, an Unwarrantable Extravagance, a Pure, Unnecessary, Expensive Luxury

When Britain returned to a gold-standard in 1925 Chancellor of the Exchequer Winston Churchill made no apologies for gold not returning to circulation. It was an “unwarrantable extravagance” as far as he was concerned. Churchill was looking at gold from one perspective.1

New Zealand’s Treasury was looking at gold from another perspective when Bernard Ashwin described gold as a “dead asset” which “had no real economic significance,” it being an “expensive luxury“ for New Zealand to possess, while returning it to circulation was a “pure luxury.” Niemeyer’s perspective, summarized in his Report as gold being an “unnecessary luxury” for New Zealand, was probably closer to Churchill’s than Ashwin’s.2

What did the Treasury mean?

The Treasury’s Perspective

New Zealand did not deserve “expensive” luxuries. Meanwhile in London…

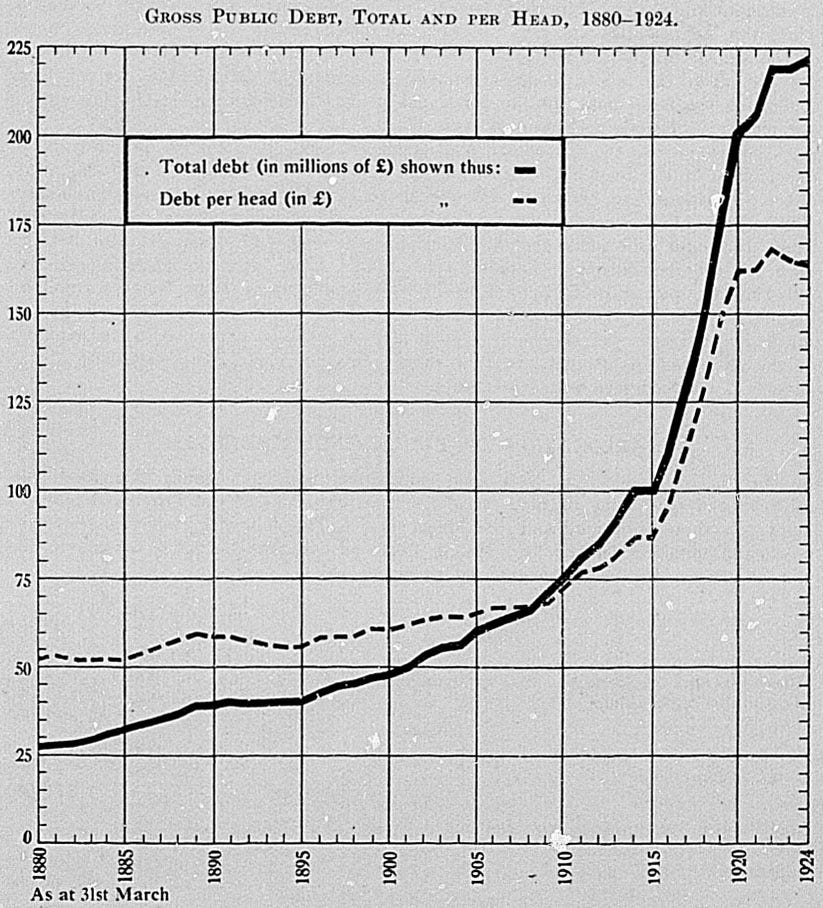

The Treasury’s primary role was to manage the Government’s financial accounts and, given government debt was around 190% of GDP by 1929, debt management and the sale of government bonds was probably its highest priority at the time. Without the debt-repayment cycle government would quickly cease to function. Banks were a primary buyer of this debt — and bonds were desired. They could be used both as a balance-sheet asset and, because of regular interest payments, an income source. All assets were used to support banks’ main business — debt.3

It was only laws and regulations that dictated the proportions of gold and other assets, such as government securities, that banks could hold. But government securities, because of the existence of counterparty risk—no matter how small—are not the same as a true-asset. They are only a balance-sheet-asset because of laws; there is no intrinsic value in this asset, just a promise of future value. An IOU. This is a bankers trick which uses a language trick.4

And laws can be changed.

By 1930 banking in New Zealand looked something like this.5

Gold represented about 10% of assets on banks balance sheets, down from 25% in 1910, government securities about 7%, up from 5% in 1910. Banks leveraged these assets into revenue streams.6

Treasury resurrects the dead

The Treasury proposed

that banks replace the “dead asset” — gold — with a ‘legal’ asset — government debt,

debt which the Treasury (bankers) were selling to bankers,

bankers who were using the debt as a revenue stream

AND

as an asset to generate other revenue streams.debt the Treasury was selling for the Government,

a Government that had declared its own debt to be a legal asset,

a Government that was using coercive means to force the population to pay its debt.7

This was a legal asset that Treasury claimed by default must be living because it was replacing something dead. Language is important.

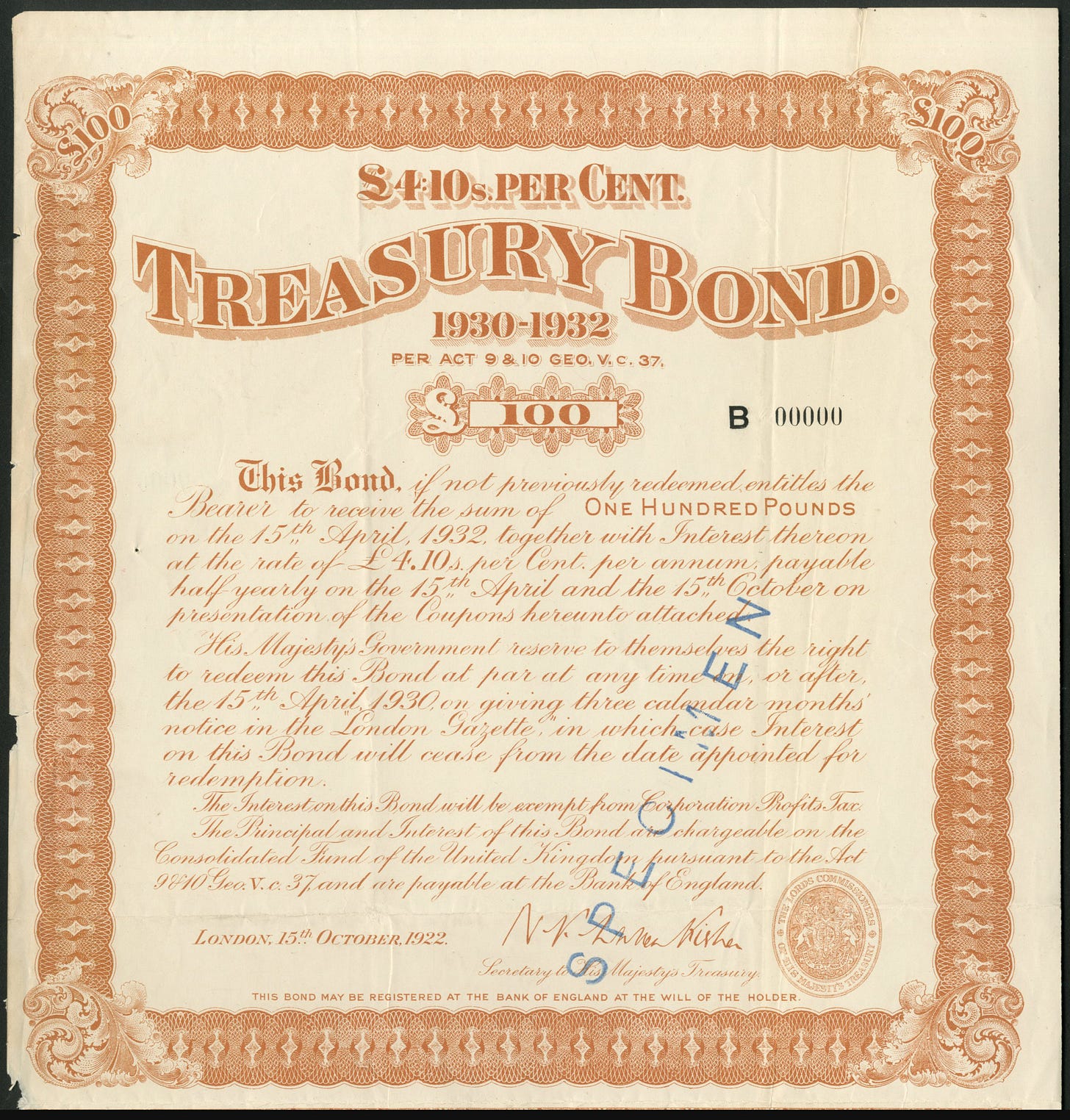

There was some truth to Ashwin’s ‘dead’ metaphor, though probably not in the way he meant. He was speaking as a banker/accountant. Because government bonds earned a passive income—i.e. interest—and were ‘growing’ they were living. Gold doesn’t. So it’s ‘dead’. Debt isn’t living of course. Bonds are a piece of paper and some entries in a ledger. But a bond is more than just an ordinary piece of paper.8

Image footnote.9

A bond is a debt contract which, because of interest,

requires extraction from the living.

The Treasury’s proposal meant all currency in circulation would first require interest bearing debt.

New Zealand’s currency would be entirely debt based.

What the Treasury were proposing implied perpetual debt for the population which could be made a mathematical certainty. When the Reserve Bank of New Zealand Act was passed in late 1933 and New Zealand’s “charter of parasitism” became law, the London bankers gained…10

The Prize

This was the “scientific basis“ of the monetary system that, facilitated by over three years of intensive propaganda and lies from the Treasury, the London bankers, the press and the politicians, New Zealand was being led in to.11

A Marxist Theory Applied

Connecting sterling-currency to government debt, backed by the future output of the working population, who would now be called the taxpayer, was a genius move from the bankers perspective. And it was also pure applied Marxism because it recognised that all value derives from labour and provided a mechanism to extract some of that value by a parasite class.12

The bankers were developing a currency which they could create using pen and paper — whether in the form of contracts or as paper banknotes. And crucially, instead of a currency which had already gained its value from past labour it was a currency which, being debt, was a promise-to-pay from future labour output. Which could be extracted from. Further, using laws and regulations they could control the supply of the currency, therefore the means of production and so society. With careful management control could be perpetual.13

That future output was the property of the individual who generated the value. Using deception and legislation the bankers were extracting some of that property with worse than zero return of value.

Marx was quite clear that his goals were to

wrest, by degree, all capital from the bourgeoisie, to centralise all instruments of production in the hands of the State…Communist Manifesto.14

This is what Gosbank facilitated in the USSR as the Communist Party debauched the currency to achieve Lenin’s “overturning the existing basis of society.”

Theft. Marxism. A central bank.

State Control of Banknotes

The passing of the Reserve Bank Act removed the banknote business from the private banks. This was just one of the many controversies. As the most publicly visible and commonly used manifestation of currency, control of the supply of banknotes was critical. Plus there was another benefit to obtaining the banknote business. Without the 4½% note tax it was very profitable. This would help fund the operation of the new central bank.15

Ashwin again:

The note issue to be fully covered by Government securities. This is practically the present requirement under the war regulations.16

Government securities and the war regulations being the cause of the massive currency supply growth globally since 1914, resulting in the “wobbling money” which caused the Great Depression in the first place.

The Treasury’s and London bankers’ solution? More of the very profitable same.

But there was a problem.

More debt was needed.

Wanting to connect valueless sterling-currency to debt was one thing. Achieving it another. Since the plan was to replace the gold with debt, obviously more debt was required. Who was going to buy the extra debt? The government was already heavily indebted and likely to remain so for the foreseeable future given the state of the global economy.17

This was a not insignificant complication. The potential market of buyers for government bonds was limited, and they were already holding the existing debt. The question was how to increase the size of the market for bonds.18

How to increase the market for Government Bonds

When growing an existing business, a good place to start is with existing customers. For the Treasury to grow the government debt market, first it needed to be possible — then a certainty — and second, bonds needed to be made a more attractive investment.

Making it possible, then certain, was easy. Government securities were already legally an asset and were used to support banks balance sheets, but only up to a point. All that was required was some speechifying in the Parliament and a few signatures on paper to change the law regulating the proportion of bonds banks were allowed as assets. The necessary gold removal could be done at the same time with the same mechanism. Even if the gold had to be confiscated. Ashwin indicated the nature of the changes required, and Niemeyer in his report was thoughtful enough to propose the necessary legislation.19

Making bonds a more attractive investment was also simple; being income streams they were already desired. Only one extra feature was needed. Reduced risk. There were two main risks for bond buyers:

1…Payment of interest and return of the Principal.

This risk was there, but low in New Zealand. Aside from a compliant population the government’s policy enforcement infrastructure was in place to coercively back up its extractive demands if necessary.

2…Decline in bond values.

Even though most bonds were probably short duration this must have been the biggest risk from the buyers perspective. It was a market risk, far from negligible given the state of the global economy, and difficult to manage. And as in any market, what concerned the buyer concerned the seller — the Treasury.20

Some means of guaranteeing bond prices was needed.

The Reserve Bank of New Zealand to the rescue.

And now we return to the question asked earlier.

What would be needed to ensure the value of your main product? Remember the answer? A guaranteed buyer. And that is what a central bank is. A central bank is a guaranteed buyer of the government’s debt. Otherwise known as

a lender of last resort.21

With the creation of the Reserve Bank the government had a mechanism to protect the value of its debt. Using the taxpayer as the insurance. Niemeyer’s language seems cryptic, but this is what he meant when he said one of the functions of a Reserve Bank was (emphasis added)

to exercise a gradually increasing influence over the credit situation in New Zealand, and by timely action minimize the disturbances in either direction which are liable to arise out of an unregulated or imperfectly regulated market.22

The Biggest Lie of All

When Ashwin said gold was “costing the people of the Dominion about £330,000 per annum”, he was bald-faced lying. This was the most outrageous lie of all. Yes, there was a lost revenue stream for banks having gold instead of bonds as a balance sheet asset. And yes, replacing gold with bonds might have resulted in a ½ percent reduction in the overdraft rate as he claimed, but here Ashwin was speculating. What was not speculation however was the source of the proposed revenue stream. The country’s population. So not only was there was no net benefit to removing gold as the asset, it wasn’t even a zero sum game.23

It was much worse.

LIE #5

Gold used by banks as an asset

WAS NOT COSTING

the country £330,000 per annum.

IT WAS SAVING

the population millions and millions of pounds.24

This lie appears to have gone unchallenged by the press and all the major parliamentary political parties; if there wasn’t active support there was complicit silence. Because of interest payments, more would be extracted from the population than any benefit they could possibly ever receive. While at the same time debasing the value of the currency through supply-inflation. Considering they were still paying for a war which had killed 9% of the male population aged ~21-40 and wounded a further 20%, New Zealanders could be forgiven for thinking the only benefits they had received so far from all the debt was misery, hurt, injury and loss.25

Image details in footnotes. The word ‘swagger’ is meant to romanticize the fact these men were homeless, jobless, included many ex-soldiers, and they were very vulnerable. Many died on the road.26

These bond contracts would give the buyers, extremely wealthy bank owners, a perpetual passive income sourced from the tax-paying population. The bank owners would become even wealthier, while simultaneously gaining power beyond imagination. This is how a bond forms the basis of an enslavement

Some Political Observations

In 1933 there were three main political parties and some independents in the New Zealand parliament. Though some MPs took exception to some provisions of the Bill, only one MP, Captain Harold Rushworth, took a consistently hard and strident public position opposing a central bank. Rushworth was an English born ex-soldier with an “outstanding military and air force record” who emigrated to New Zealand in 1923, and entered Parliament in 1928 as the sole M.P. for the Country Party. This gave Rushworth independence from the Whip.27

As the Bill approached its final reading in the House, Rushworth, speaking in Parliament and with the apparent support of his local newspaper the Northland Age, displayed his intense suspicion of the central bank idea and its origins. In light of the developments over the last 90 years Rushworth’s words, though not one hundred percent accurate, are more than prescient. Today they read like a soothsayers forecast come true.28

His sentiments can be summed up thus.

When we look at the effect of the establishment of the Reserve Banks in other countries we find simply a trail of ruin behind them…There is not a single instance of a Reserve Bank that has been established that has worked in the interests of the people…

Quoting the President of the Texas Steel Company, C. W. Armstrong, Rushworth claimed opposition was diverse.29

…a number of leading industrialists and commercial men, financiers, diplomats, people in every walk of life, for condemning the central or reserve bank idea as thoroughly unsound and opposed to the interests of the people

Perhaps Rushworth’s most controversial statement was this one, though it didn’t appear to cause even a ripple (emphasis added).

There is a definite movement to transfer the control of the monetary systems of the world to the control of a private junta, the directorate of the Bank for International Settlements, and if that scheme comes into operation, sooner or later the peoples of the present self-governing nations of the world will realise that they have lost, or have had filched from them, the supreme power of government, and that they have been subjected to a form of dictatorship from which there is only one escape…a world-wide bloody revolution.

Strong words.

Rushworth claimed there was a conspiracy by bankers to create an “international monetary system based on gold and controlled by the irresponsible directors of the Bank for International Settlements.“ In case it might be thought these were the views of one deranged individual, Rushworth was apparently echoing wider views held in the community, barely reflected in the press.30

The Leader of the Legislative Council Sir James Parr, speaking in support of the Bill when introducing its second reading, unveiled some deeper detail of community sentiment. Aside from the usual contempt for the population repeatedly shown by some of the governing class, seen here by the cultural cringe and sense of noblesse oblige Parr exudes, his speech reveals much more (emphasis added).31

…the Government is acting in conformity with legislation to establish a central bank. The idea is, of course, new to New Zealand, and the fact that it is a new thing accounts for a good deal of the criticism. New Zealanders are always prone, I fear, to regard with grave suspicion any new thing or any novel idea. Furthermore, some of our community is often apt, not only to be suspicious, but to be abusive of sound, new principles, when they are brought forward…I have heard it said that it is a cunning conspiracy to bring our banking system under foreign control — an insidious move to enslave the people of the Dominion. Sir Otto Niemeyer has been pictured as the paid agent of a coterie of cruel, merciless, international—generally German Jew-financiers, who are bringing the whole world under their awful sway…Sir Otto Niemeyer…comes of four generations of men of his family born in England, and, therefore, full British subjects…Sir Otto I know to be a Britisher through and through…It is not only, therefore, a poor argument, but it is a false argument to say of this man that he is actuated by base ulterior motives.32

There was apparently widely held deep suspicion of the idea of central banking, and Niemeyer and the bankers had obviously come in for some scrutiny.

Douglas Credit

In the previous essay I claimed the global political movement founded by Major Clifford Douglas, Douglas Credit, was a psychological operation in the form of a controlled opposition. It appeared at the exact time the international bankers were beginning to roll out their central banks globally, was the largest and most organised opposition movement, had a global reach and would appear to have been very well funded.

Douglas Credit and its global offspring achieved nothing while absorbing much of the opposition energy. They appeared to be challenging ‘the prize’ — interest bearing debt based currency — but they never challenged the fundamental idea of an intrinsically valueless currency. Their solution, essentially spending currency into existence without debt or interest, would have been far far worse than the debt-based currency being proposed, and it was easy to show.33

This is not to say the followers of this movement were involved in some grand conspiracy. Wobbling money was a problem globally and people were searching for solutions. And an organic opposition to the central banking proposal was inevitable. It’s probable ninety-nine percent of Douglas Credit supporters, possibly even the leader, were genuine.34

Because the flaws of the Douglas Credit proposal were so obvious, and it is so easy to demonstrate this in-order to raise doubt in people’s minds, Douglas Credit should never have gained the prominence it achieved. Yet it did. Like Modern Monetary Theory today.

There is more than one way to control the opposition.35

Did no-one see through the misdirection and fraud?

Rushworth was the most prominent opponent of a central bank, but opposition was nationwide and seemly all elements of New Zealand society were represented. There is enough material for a book. Perhaps it is best epitomised by the lengths the central bank proponents went to, to propagandize the population. Though there is little in the press to indicate the real threat was understood, there is enough to indicate a realization by the conspirators of the need to preempt the possibility of this understanding getting any oxygen.36

Intensive propaganda

At the peak of the debate, a few months before the Reserve Bank Bill was passed, the Dominion published an over 8000 word article that was possibly the most egregiously misleading example of propaganda seen in the press since gold was confiscated in 1914. Produced by the Finance Minister Gordon Coates it was openly the Government line, so it is safe to assume it was the Treasury line also (emphasis added).37

The article…discusses central banking…control…and the monetary standard, the Reserve Bank of New Zealand Bill…misconceptions. Advantages that will accrue…DOMINION, 8 SEPTEMBER 1933, PAGE 6

The use of the word “misconceptions“ and promises of future “advantages“ warns this article was intended for narrative control and propaganda purposes, and it’s a fine example. Written to “enable the New Zealand public to fully understand and appreciate the clauses of the Reserve Bank of New Zealand Bill” it does this and more. It reveals the nature and scope of the opposition and neatly summarizes the lies required to implement the new financial system. A few exemplars…

There was some of the bait and switch already seen, with the motives of the private banks questioned:

banks are organised primarily to make profits for shareholders, and the control of our credit and currency, which at present remains with them, is only incidental to maintaining the soundness of their own business.

An unworthy statement for a Finance Minister to make as well as factually wrong. The implication that a bank’s profit and credit control were disconnected was absurd. The private banks had at least as much motivation to achieve a stable currency as their customers. Referring to the Reserve Bank’s note-issue, which would be exchangeable for sterling-currency (emphasis added).

The effect will be exactly the same as a gold standard bank being required to give notes for gold and gold for notes at a fixed price. We will get all the benefits without the heavy cost of keeping our own gold reserve.

As seen above, this is the opposite of the truth. There were no guaranteed “benefits,” and a guaranteed “heavy cost” would be the result of the changes and the new debt-based currency (emphasis added).

a uniform and absolutely secure note-issue. A uniform note issue would be a commercial convenience…a centralised note-issue…would inspire the utmost confidence, and have a prestige that would be of great value in emergencies. In addition, a single control of the note-issue is an important factor in the maintenance of sound economic conditions.

Irrelevancies, unproven claims, undeliverable promises and emotive language…the examples seem endless. Two more examples will suffice to conclude the point. Coates, making more promises he couldn’t keep, said the new Reserve Bank would have a (emphasis added)38

small office in Wellington with a staff probably not exceeding twenty in number

And from the official Encyclopedia of New Zealand (emphasis added).

The Reserve Bank opened for business in 1934 and by 1935 it had 60 staff…source.

Coates also said the Reserve Bank would be

entirely free from the possibility of political influence

Again, promises he couldn’t keep ([ ] added).

[originally] it was two-thirds owned by the government and one-third by private shareholders…In 1936 the new Labour government nationalised the Reserve Bank…source.

These last two examples seem trivial. They’re not. They show clearly how the men making the promises had no idea what they were offering, and no control even if they did. The politicians were patsies for the bankers. Like today.

This article generated heat, and the following week the Dominion published a few of the letters it had received. Some correspondents seemed to grasp the real problem (emphasis added).39

It is proposed to invest New Zealand funds in Government securities, commercial and agricultural paper, and Treasury bills. This appears to make the bank but a further means of easy Government borrowing…

the Government…have us committed to a system which they, themselves, do not understand, and which the leading bankers in the world have failed to operate successfully, and place upon the rising generation a burden of oppressive taxation which may take generations to lift…

While the ability of the government to achieve its stated aims was doubted

The claim for the measure that it will result in cheaper money for the Government, illustrates the sublime futility of the Government where finance is concerned

Others were rightly suspicious of the motivations of those pushing for a central bank.

For some unknown reason, great pressure must have been brought to bear by the Bank of England, and it seems that they are insisting that a central reserve bank be established in this country, quite obviously to strengthen its position and not ours

After yoyoing between the House and the Legislative Council the Reserve Bank Bill finally became law in late November 1933. The passing of the Reserve Bank of New Zealand Act didn’t stop the controversy, and more work was required before it opened its doors. But it didn’t matter. The Communist Manifesto’s essential Measure 5 was in place40

the centralisation of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.41

New Zealand had stepped onto the road to ruin.42

“It isn’t some wicked Bolshi plot, George, to lure us to our ultimate destruction?”43

Coming next: PART 5: New Zealand’s Financial Resets: The Reserve Bank Road to Ruin.

See full texts of some of the documents used in Part 4.

Previous: Treasury Beguiles and A Prussian's Wiles: An Orchestrated Litany of Lies - #3 and #4

Home: New Zealand’s Financial Resets

“Churchill“

Winston Churchill was possibly in the pocket of the Rothschild bankers due to the debt owed by his father Randolph* on his death. If true, Winston’s verbal debasement of gold is unsurprising.

* There are many sources describing Randolph’s extravagances and debt. And he died young (45). Even Wikipedia: “Churchill was a friend of Nathan Rothschild, 1st Baron Rothschild, and received "extensive loans" from the Rothschilds.” Source.

“unwarrantable extravagance“

gold currency in domestic circulation was not necessary…this use of gold would be an unwarrantable extravagance which the present financial stringency does not permit England to indulge in…Federal Reserve Bulletin, June 1925, pp 369. Source.

See also:

https://fraser.stlouisfed.org/files/docs/historical/eccles/049_02_0003.pdf

https://www.parliament.uk/about/living-heritage/transformingsociety/private-lives/yourcountry/collections/churchillexhibition/churchill-the-orator/gold-standard/

This must have grated on Britain’s population, who less than a decade earlier had suffered over 1.5 million casualties in a war that had beggared them.

“Churchill was looking at gold from one perspective“

Britain needed physical gold, in the vault, to back its debased sterling-currency for any hope of success for its new gold-exchange standard. From that perspective, given it had expended an enormous amount during the war, circulating gold specie coin was out of the question.

This is what Ashwin meant when he said in reference to the gold in New Zealand banks vaults being shipped to London “another £6,600,000 of gold would be an appreciable gain to the banking reserve of the Bank of England…a graceful gesture to the Mother Country.”

Another factor, which wont be examined here but no-doubt complicated relations between the New Zealand Government and the banks who were negotiating the price of the soon-to-be “confiscated” gold, was the U.S. confiscation of gold in April 1933 (Executive Order 6102) at a price of US$20.67 per ounce and the subsequent devaluation of the U.S. dollar against gold in January 1934 to $35 per ounce. See also:

https://www.federalreservehistory.org/essays/roosevelts-gold-program

“debt management and the sale of government bonds“

Treasury sold government debt* and managed the timely payment of interest and repayment of the principal when bonds matured. Government would cease to function as we know it without the timely funding enabled by debt. Today the Treasury sell several hundreds of millions of dollars of government debt, also known as sovereign debt, each week or so.

All government debt is repaid using government income. Before the 1914-1918 war total tax accounted for about 50% of government income of which income tax was a part of. The remainder coming from duties, tariffs etc. and debt.** See New Zealand Yearbooks for data.

“government debt…190% of GDP“

Central and local government combined. GDP as we know it today was not a measure at this time. The following data is from Reddell (2012).

By 1932 government debt was 300% of GDP. Reddell implies this was due to a drop in the GDP, which is true but may not be the whole story. I haven’t researched this but I suspect further bond sales contributed significantly to the increase. Interest alone was crippling. Central government was estimated to be spending one third of its revenue on interest even before the Depression officially started.

Private debt was also high

In respect of private debts, the Government Statistician provided a one-off estimate of total mortgage debt (urban and rural) for 1931, equivalent to 140 percent of pre-Depression GDP…Reddell (2012) p 38.

Reddell, Michael, The New Zealand Debt Conversion Act 1933: a case study in coercive domestic public debt restructuring, Reserve Bank of New Zealand: Bulletin, Vol. 75, No. 1, March 2012, pp 38-39.

“bonds”

https://www.etymonline.com/word/bond

https://www.investopedia.com/terms/b/bond.asp

“creating currency“

For example banknotes and credit contracts.

Banknotes = currency ; credit = debt = currency.

* “sold government debt“

The debt was in sterling-currency. The words ‘sterling-currency’ were just another way of saying gold. So when the bankers were creating debt, in sterling-currency, they were ‘creating gold.’ More accurately they were creating a contract; a promise to pay. In gold. Which was never delivered on, because they changed the rules (i.e. laws).

** “and debt“

Government debt is not necessarily completely evil, as long as it is very short term. Months rather than years. New Zealand now has 30 year bonds. Debt is useful to smooth cash flow; i.e. tax income is relatively intermittent whereas many costs are fixed and constant. However this debt, in my opinion, should never be monetized.

I am not arguing against debt as a balance sheet asset for business-to-business relationships. I am arguing debt should not be the sole asset backing currency. And peoples savings should always be backed by physical property (plural) that retains purchasing power over time.

“It was only laws and regulations“

It was recognised government securities were not the same as gold because they were riskier; there is zero counterparty risk with physical gold in the bank’s possession. That is why the laws were originally in place. To protect banks’ customers from risk.

For clarity other balance sheet assets are not included.

“Gold represented about 10% of assets“

Valued at about £6.6 million sterling according to Ashwin, albeit a value based on Britain’s manipulated gold standard. See here.

“into revenue streams“

Some which could in-turn become assets themselves — such as loans.

“coercive means“

Legal system, courts, police, prisons…

“Bonds are a piece of paper“

Today it’s all electronic, though no doubt the process generates a lot of paper.

This bond document has interest of £4.10s per Cent. 20 shillings per £ so this is 4.5%.

“mathematical certainty“

By creating so much debt with some event—another World War for example.

“charter of parasitism“

Irish writer/philosopher

“scientific basis“

Bernard Ashwin quoted by the Dominion newspaper to describe what was coming. DOMINION, 4 SEPTEMBER 1930, PAGE 8

“a genius move“

It took advantage of the miracle of compounding interest. See for example:

https://michael-hudson.com/2007/08/why-the-miracle-of-compound-interest-leads-to-financial-crises/

https://www.investopedia.com/terms/c/compounding.asp

“pure Marxism to boot“

While Marx didn’t invent the labour theory of value — all schools of economic thought considered labour — the extraction of the value of labour was a cornerstone of his economic work Das Kapital. Though he wrapped his economic theory in the language of exploitation, when combined with his earlier work it is obvious Marx was seeking to identify sources of value to fulfil his ultimate goal of Communism; to

wrest, by degree, all capital from the bourgeoisie, to centralise all instruments of production in the hands of the State…*

* Karl Marx and Frederick Engelts, Manifesto of the Communist Party, (1848)

Control of the means of production is achieved through control of the currency’s quantity and destination.

“all value derives from labour and provided a mechanism“

This is exactly what the Bolsheviks did with Gosbank in the USSR. See

“was a currency which, being debt“

There was one exception. Though all private bank created currency was debt based, the gold confiscated from the banks (which had been previously confiscated from the population) was going to be used by the new Reserve Bank as one of its assets. Any and all assets in turn backed the banknotes and the various reserve asset ratios changed. To give an idea of the situation:*

24 Sept. 1934: Banknotes £8.7 million, gold reserve £4.4 million i.e. ~50%.

16 Dec. 1935: Banknotes £10.4 million, gold reserve £2.8 million i.e. ~27%.

As late as January 1974 (as recently as I have looked) there was still $0.7 million in gold on the Reserve Bank’s balance sheet. My guess is this was all physically situated in London. The gold will be followed in the next part of this series.

* Numbers rounded. Data from the New Zealand Gazette, 27 Sept. 1934, 19 Dec. 1935 and 7 Mar. 1974 respectively…http://www.nzlii.org/nz/other/nz_gazette/.

“could extract from“

Via interest payments.

“means of production“

Previously the sole domain of Marx’s “bourgeoisie.”

“control could be perpetual“

When one bond matures and the principal returned another bond is purchased…this can repeat itself with careful management forever. Which they have done ever since. That is the purpose of the definition and measurement of metrics like GDP, CPI, M1, M3…to provide the necessary data to perpetuate this cycle as long as possible. But the London bankers first needed to entrench the debt. WW1 had achieved a lot and debt from another war would embed the system permanently. These are big topics and will be covered in the future. Whether this implied claim of intentionality is believed or not is ultimately irrelevant. That is what happened.

“worse than zero return of value“

Because they could and would continuously debase the currency.

“Marxism“

Marxism, fascism, socialism, communism…all the ‘isms’ are just different walls of the same control matrix called statism/collectivism.

“control of the supply of banknotes was critical“

This is all about bankers trying to artificially simulate the natural scarcity of gold and silver and an acknowledgement they at the very least need to slow the debasement* and consequent loss of purchasing power in order to hide the incremental theft.

Banknote supply, which had originally been constrained by physical gold and silver before this was exploded with the August 1914 suspending legislation, was now in theory able to be expanded ad infinitum** unless constrained. Because this ‘circuit’ of currency (i.e. cash) directly impacts day-to-day consumer prices, if the supply had been increased too rapidly the currency debasement, which was an intrinsic property of this new system, would have been obvious as consumer prices inflated.

Coinage was already under the control of the state. Until New Zealand’s first coins began to appear in 1933, Britain’s coinage was the sole legal-tender coinage. Because of the low silver content—British coins had already been debased to 50% and New Zealand’s coins were the same—it was recognised this was only “token money”,*** indicating the coins’ low intrinsic value compared to the face value.

Section 8 of the Finance (No 2) Act 1932 (23 GEO V 1932-33 No 45) enabled the Minister of Finance to begin the process of minting New Zealand coinage at the Royal Mint, and the first coins, half-crowns, appeared in New Zealand in November. The Coinage Act (1933) (24 GEO V 1933 No 12) with coin specifications was eventually passed on 27 November 1933 and came into operation on 4 December 1933.

“4½%“

DOMINION, 18 NOVEMBER 1933, PAGE 9—Government and Gold

The sting for the banks’ Note business was the note-tax of (by 1933) 4½% which cut into their seigniorage profit. There is no evidence the banks were too concerned about losing the Note business; given the trade-off — income-generating government securities as the main revenue generating asset — this is not surprising. The Note tax was eliminated with the creation of the Reserve Bank. The theory was the Government, as a shareholder of the Reserve Bank, would share the profits.

“very profitable“

Seigniorage. See also:

* “debasement“

An intrinsic property and mathematical certainty of debt-based currencies.

** “in theory able to be expanded ad infinitum“

With the legal ability to use government debt as a balance sheet asset, and because government debt could grow while there was still a buyer.

*** AUCKLAND STAR, 1 NOVEMBER 1933, PAGE 11—SILVER COINS

**** This is a caricature; a banknote has unique paper, fine artwork, symbols, a serial number and other security features to make it more difficult (= expensive) to forge.

The Treasury and Government had been assiduously working on taxes, the other easily malleable source of government income, which had increased from about £6 million in 1915 to £19.5 million fifteen years later*, growing over 8% every year. There was a limit to the possible extraction from the population, and it was tapped out, especially as the Depression progressed. More debt meant more interest, which either meant more taxes — and there was none to be had — so the debt cycle starts. Debt to pay interest to pay debt to pay interest to pay debt to pay…

* “taxes…increased…fifteen years later“

Meanwhile taxes overall increased from ~50% of total government income to over 75% in the same period.

Source: New Zealand Yearbooks

“market of buyers for government bonds was limited“

Aside from the finance sector (e.g. local banks, the London money markets, insurance industry) buyers included public works funds, State Advances, Returned Soldiers funds, Superannuation funds and a myriad of other central and local government funds. Source: New Zealand Yearbooks.

“only up to a point“

Even though the legislation had been suspended since 1914 and currency was by 1933 backed by a range of securities, the suspending legislation was due to expire.

“necessary gold removal“

To make gold’s replacement with bonds certain.

“Even if the gold had to be confiscated“

This is why are fight between the banks and Government over the sterling price for the gold was so important. The banks would need to replace the gold asset with bonds, and the more bonds the banks could buy for the gold the better, from their perspective.

“probably short duration“

In theory as more bonds were created with short durations their value would reduce — a consequence of supply/demand and a recognition of the government’s straightened fiscal position. I haven’t looked at the New Zealand situation but it can’t have been much different from Australia given the buyers were in many cases the same,

Much of the Australian debt was quite short term…Reddell (2012) p 39.

One solution was to have longer bond durations, basically a different product with a different market; a market undeveloped in New Zealand*. Longer maturity bonds would also be more expensive for the government. They would — if the bond market was working properly — require higher interest payments. It’s a mathematical thing.

If this is new and you’ve got a bit of math, Investopedia is as good a place to get started as anywhere. https://www.investopedia.com/terms/b/bond-valuation.asp

* I suspect part of the rationale for the Reserve Bank was to develop this long term bond market — Niemeyer says as much in his report, albeit speaking in tongues. Today (2024) New Zealand is selling two 30 year duration government bonds.

This does not mean a central bank buys all of the government debt. In fact it is hoped the central bank buys very little debt except what is need to support their balance sheet, especially the banknote business. But just by being there, a shadow hanging over the bond market, the purchasing banks know if they need to sell before maturity the price at least has a floor, because if the price drops below some predetermined and preannounced* level the central bank will step in and buy. Using currency created from thin air.

* By publishing discount rates which the Reserve Bank would buy government securities at.

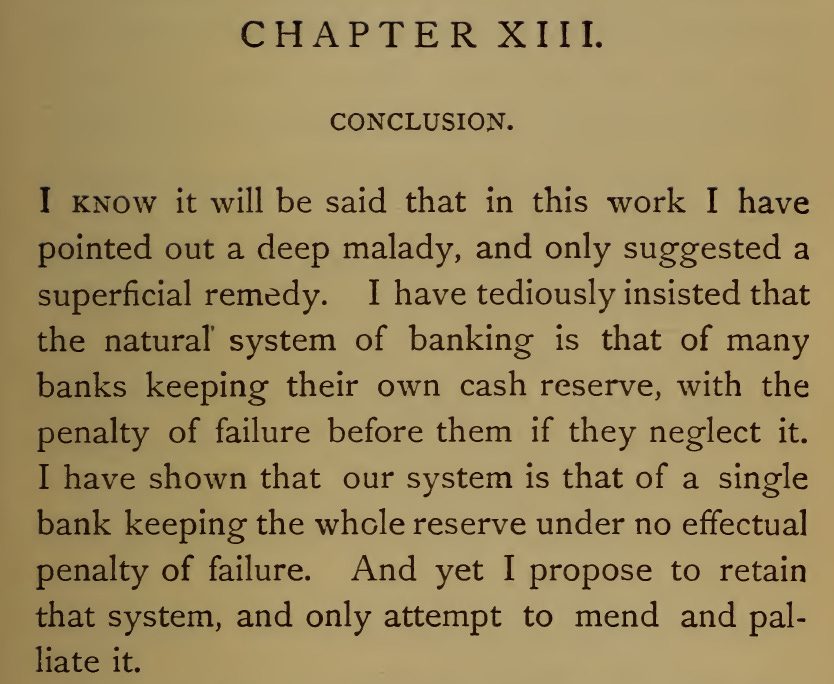

The idea of a lender-of-last resort is credited to Walter Bagehot in his 1887 description of the London money market Lombard Street. Bagehot recommended the Bank of England should act as a lender of last resort. But he also said it would be better if England never had a central bank at all. He recommended the lender-of-last-resort rule to minimise the harm being done by the Bank of England.

Bagehot, Walter, Lombard Street—a description of the money market, Charles Scribner’s and Sons (1887) p 329.

“minimize the disturbances…unregulated or imperfectly regulated“

This is a euphemism for “protect the value” by creating currency out of thin air to buy bonds and artificially inflate prices. When necessary.

Niemeyer, O., “Banking and Currency in New Zealand”, (1931) p 4.

https://www.rbnz.govt.nz/hub/publications/guide/1931/otto-niemeyers-1931-report-on-banking-and-currency-in-new-zealand

“most outrageous lie of all“

This is obviously subjective, but my justification for this position is the other lies were cumulative and entwined. This lie stands alone. It’s easy to show and mathematically prove, and doesn’t need support from other lies. And it was this lie which more than any other that facilitated the perpetual taxation enslavement of today.

“revenue stream“

The key word here is ‘stream.’ The bankers wanted this stream to flow as long as possible.

“The country’s population“

The laws and regulations (both existing at the time and in the future) allowed banks, under certain conditions, to own British Government and Commonwealth-nation securities as well.

In interest payments. Over time £s would become $’s. Millions would become hundreds of billions.

“appears to have gone“

I haven’t examined every story in Papers Past or speech in Parliament. But I’ve read a lot and haven’t yet seen anything that would pass as a sustained public opposition apart from that discussed below.

“three main political parties“

Reform & United formed the government, Labour was the main opposition. https://en.wikipedia.org/wiki/1931_New_Zealand_general_election

“some MPs took exception to some provisions“

There are plenty of examples. Mr. Wright, a back-bench MP from the Reform Party — which was part of the Coalition Government — as well has having general doubts, took exception to the gold confiscation from the banks.

This…is one of the most revolutionary measures that have ever been before this House, and those who vote for it will be doing so with their eyes open, and they must accept the responsibility for their action…If I voted for that sort of thing," declared the member, "I would feel that I was in the company of Turpin, Ned Kelly and other brigands…AUCKLAND STAR, 1 NOVEMBER 1933, PAGE 8 — STRONG WORDS.

Apparently “Mr. Wright said he failed to see how the Reserve Bank would assist in the rehabilitation of New Zealand.”

“Harold“

Rushworth is listed as “Harold” on the Parliamentary Roll, but appears at least once in Hansard as “Henry.”

“outstanding military and air force record“

GREYMOUTH EVENING STAR, 30 JUNE 1950, PAGE 2

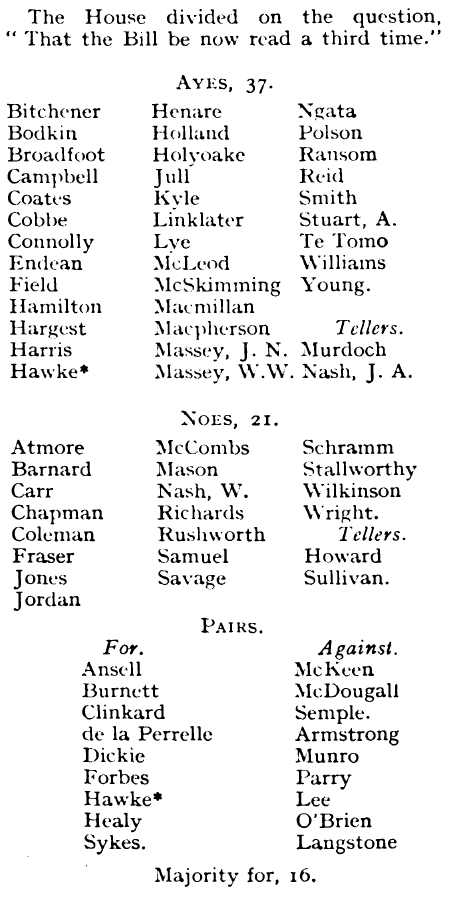

Aside from Rushworth the other parliamentary political parties all supported the idea to some extent, though they had different and changing visions.* The final vote did not reflect this of course, as party politics took over. Labour could always say they had opposed the Reserve Bank…until they nationalised it a few years later. From the Hansard of 2 November 1933. The “Bill” here is the Reserve Bank of New Zealand Bill.

“associated with the Douglas Credit movement“

As nearly every opponent to a central bank was at some time or another.

* There are thousands of reports returned from a search of Papers Past for the years 1931 to 1933 alone, though the number obviously depends on the search criteria. For example the search below returns nearly 9200 results (June 2024). Public meetings, political speeches in and out of Parliament were covered in detail. Editorials, the views of business and union leaders, so-called experts, letters-to-the-editor received long columns.

The only thing that can be said with certainty is the debate was varied, confused, and divisive. It is clear the public and politicians did not understand* what the actual cause of the problem was (i.e. the cause of the "wobbling money” and depression) let alone the solutions on offer. A nuanced examination would require a book.

* Maybe “did not understand” is too harsh. There are indications some of the public at least did understand. For example a correspondent to the Editor of the Evening Post in late 1933.

May I suggest to the numerous amateur financiers and cambists who are airing their views pro and con the annexation by the Government of the banks' gold that rather than say gold has risen in value they should say that our currency has gone down in value—thanks, of course, to the Government…EVENING POST, 9 NOVEMBER 1933, PAGE 3

“suspicion of the central bank idea and its origins“

…The question has been asked and as far as I know, it has not been answered —who asked for this Bank…one wonders if that is the Government that has asked for this bank…I have not heard any valid reason for the institution of the bank. Now I want to know who has asked for this Reserve Bank?…Where did the proposal originate?…The Chairman of the Bank of New Zealand, in his annual address, said, “The Reserve Bank Bill is being put through at the dictation of London financiers.”…NORTHLAND AGE, 17 NOVEMBER 1933, PAGE 3

Today the reports and documents from the post-WW1 economic conferences are available and we know the plans for central banking came from these conferences, the League of Nations, and ultimately men like Otto Niemeyer, Theodore Marburg and other representatives of powerful financial interests.

For more see:

“Quoting the President of the Texas Steel Company“

See the quote that opens this essay.

“Rushworth claimed there was a conspiracy“

I believe that the principal reason for calling the World Conference was to bring into existence an international monetary system based on gold and controlled by the irresponsible directors of the Bank for International Settlements, and further that it was owing to a split in the upper regions of high finance that it was torpedoed.

That was one of the reasons for calling the Ottawa conference. That is only part of the main proposal. The world conference concentrated on it with the idea of amalgamating all the reserve banks in the world, and placing them under the direction of the Bank for International Settlements, with its headquarters at Basle. That was very nearly carried through. I believe that the principal reason for calling the World Conference was to bring into existence an international monetary system based on gold and controlled by the irresponsible directors of the Bank for International Settlements, and further that it was owing to a split in the upper regions of high finance that it was torpedoed.

There appear to be two groups struggling for supremacy—the Bleichroder-Mendelsohn groups and the Rothschilds group. They fell out. The Rothschild group having cornered gold had set the stage for setting up this international control, but at the last moment the Bleichroder-Mendelsohn group made a dramatic move. Mr. Baruch, the representative of this latter group, was able to influence President Roosevelt at the psychological moment, and he refused to march to the tune arranged by the Rothschild group and so torpedoed the whole show. That was the only real reason I can find for the failure of the Conference. In my opinion that failure saved humanity from a terrible disaster…NORTHLAND AGE, 17 NOVEMBER 1933, PAGE 3

“barely reflected in the press“

The NORTHLAND AGE item was unusual as it gave serious coverage to Rushworth’s speech. This may have reflected his status as the local MP. He was often presented as slightly eccentric or a crank. The golden age of abusive ad hominem attacks by the press and media was still to come.

“irresponsible directors of the Bank for International Settlements“

Niemeyer was one of these directors.

Despite his suspicion of, and opposition to, central banking, Rushworth still believed currency was the responsibility of the State.

that the control of the monetary system, that is to say, the right to manufacture, to issue and retire money, is a prime function of Government…

it is the most important implement of Government the control of the manufacture, issue and retirement of money. That is hardly debatable…

there is no higher authority to which the control of the monetary system can be handed. The function of the control of the monetary system of New Zealand must remain vested in Parliament if New Zealand is to retain the right of self government…NORTHLAND AGE, 17 NOVEMBER 1933, PAGE 3.

“Sir James Parr, speaking“

15 November 1933, at about the same time as Rushworth’s speech reported by the Northland Age.

Parliamentary Debates v.237 1933, Third Session, Twenty-fourth Parliament, November 1 to December 22, 1933 p 230.

“New Zealanders…prone…regard with grave suspicion any…novel idea.“

Cultural cringe.

[Personal note: this sort of thing disgusts me. New Zealanders were right to be suspicious. It’s likely they knew they were being exploited. Many of their number had been killed or badly wounded in the ‘Great’ war. Which they were now paying for with increased taxes, a worthless currency, and now they were being beggared by a Depression! Likely many knew they had been lied to. They had had their gold stolen in 1914; the silver stolen from their circulating coin in 1920. Their sterling-currency had been debased so badly by bankers with the connivance of government that even the press were calling it “wobbling money.“ So excuse me if I get agitated when I read words like this — no apologies for this language — from a piece of #%&$ like Parr.]

“sound, new principles“

Not only is this internally contradictory (i.e. an oxymoron) — something can’t be both “sound” and “new” — these “principles” of “modern universal banking” so far implemented (Austria, Hungry etc.) had been an abject failure in improving the condition of the affected populations to that date, as Rushworth pointed out in his parliamentary speech. The bankers had made out like bandits (i.e. been repaid).

As Machiavelli said

people are naturally sceptical: no one really believes in change until they've had solid experience of it…Machiavelli, The Prince (1532).

“four generations of men of his family born in England“

This contradicts Niemeyer’s Wikipedia biography which says his father was an immigrant from Hanover, Germany. If nothing else it reflects the confusion about the background of a man who appeared to have imposing influence over the government.

Douglas Credit’s policy was a recipe for disaster, in that at least under the proposed Reserve Bank model there was some restraint on currency creation — it first required the creation, sale and repayment of debt. Douglas Credit also proposed creating the currency from thin air so there is no intrinsic value. But it proposed government spending the currency into existence. In other words government wouldn’t even be constrained by debt. This would have been a license to debase currency; governments do not have a record of restraint.

The only thing required to control a movement is to control the funding. If wealthy financiers wanted a controlled opposition all they would have had to do was find someone they could use who was already active, and feed resources in that direction. Growth would be organic.

The economic policy of the Douglas Credit movement, known as Social Credit in New Zealand, are detailed and beyond the scope of this essay. Suffice to say Clifford Douglas had views on everything from currency to industrial development to private property…and of course debt/credit. This latter is the only concern here.

Douglas’ books and writing.

Today Douglas Credit looks to me like a devilish bastard-parent of Modern Monetary Theory and Technocracy. In essence Modern Monetary Theory has at its core the issuance of interest-free debt ‘money’ by government, and technocracy has energy as its base currency.

the real unit of the world's currency is effort into time what we may call the time-energy unit…Douglas, C.H., Economic Democracy, Cecil Palmer, London (1920) p 100.

“opposition was nationwide“

There are hundreds of examples in the press (Papers Past) of meeting reports, letters to the editor, advertisements of public meetings, education classes…

Right up to the eve of the final vote (in the Legislative Council) public meetings opposing a central bank were held. This one obviously got a bit heated.

The interjector…interrupted several times, and finally was escorted quietly from the hall by a police constable.

GISBORNE TIMES, 8 NOVEMBER 1933, PAGE 2 — RESERVE BANK. PROTEST AGAINST SCHEME. LARGE MEETING IN WELLINGTON. DRASTIC COMMENTS BY SPEAKERS. APPROPRIATION OF GOLD. “BAREFACED ROBBERY.”

“enough material for a book“

That this hasn’t already been done is both a mystery and revealing. I have thoughts on this, for another time.

“real threat“

A currency based solely on perpetual interest-bearing debt which has no intrinsic value.

“8000 word article“

Word count from https://wordcounter.net/

“most egregiously misleading piece of propaganda“

Given propaganda was essential for the Government to lie its way into World War 1 this is perhaps hyperbole.

“assume it was the Treasury line also“

Without question the Treasury would at the very least have had input, and was probably drafted by its staff.

“the examples seem endless“

The article as a whole was simply a sales pitch. It was riddled with propaganda devices.

Childish argument.

analogy of a water-supply

Misdirection.

Cash…

…being required for little beyond payment of wages and till-money in the retail trade

More lies.

…always has been, a sterling exchange standard…

…no fundamental change of system is involved…

Contradiction and oversimplification.

sterling exchange system simply means working on London balances instead of on a stock of gold held in the country

Appeals to nationalism.

the national interests should always prevail…our pound

Promises of future nirvana.

anticipated that considerable benefit will accrue from cheaper credit

Cultural cringe and ad hominem-type language.

It has been suggested that New Zealand is too small to have a central bank, but people who say this do not realise the true purpose and functions, of such an institution…It might be pointed out that we have managed reasonably well without a central bank up till now, but to say that is to deny all progress. Our forefathers got along reasonably well with very primitive forms of barter, but now…

Fear.

collapse of New Zealand currency might

“Legislative Council“—for example

TARANAKI DAILY NEWS, 17 NOVEMBER 1933, PAGE 5—VOTE IN THE COUNCIL

“finally became law“

The Reserve Bank Act (dated 27 November 1933). Not immediately enacted. The process of implementation required further fiddling with the law, proclamations, hearings, committees...

“didn’t stop the controversy“

Just one example, from the day after the Act was passed, was the gold ownership.

EVENING POST, 4 NOVEMBER 1933, PAGE 14—WHO OWNS THE GOLD?

It wasn’t quite the “centralisation of credit” — not directly anyway. The Reserve Bank did have a monopoly on banknotes, but not on credit. The banks had that business. But they didn’t have a credit business without Government Securities. Which the Reserve Bank controlled. So using a more nuanced mechanism than direct control, the Reserve Bank would have “an exclusive monopoly” on credit; still an effective layer of control for the London bankers. New Zealand’s model was just different.

“road to ruin“

New Zealand’s record since then has been a wild ride of stolen silver, currency resets, ever increasing public and private debt, inflation, stagnation, growing trade deficits and economic tumult. And finally the, first gradual then accelerated, almost complete financialization of the New Zealand economy.

Sir Saul Enderby rhetorically questions George Smiley, Smiley’s People, BBC, (1982), episode 5, at ~15min.